Should schools teach students more practical things like Managing Accounts, Investments etc

Views: 1124

“Tell me and I forget, teach me and I may remember, involve me and I learn. “

-Benjamin Franklin

Education forms the fundamentals on which we lead our life. The kind of life we lead shapes our perspectives and influences. Thus education plays a significant role in shaping our future. Without proper education we are all but hollow beings roaming on this planet. Education with proper tenets imparts a sense of purpose and direction to our life. Formal education with inputs from practical facets of life work wonders as such a curriculum teaches aspects that play a pivotal role in our later lives – application and innovation.

A literate person, novice in finances cannot plan his/her career financially leading to either overestimates or underestimates causing future headaches. In India, imparting financial literacy is pivotal and consequential. Financial literacy in its basic form is the ability to comprehend and make effective use of financial skills like personal finance management, budgeting and investing. It serves as the foundation of our relationship with money. Financial literacy is achieved through imparting quality financial education. Hence by realizing and understanding the aspects of these competencies, citizens gain the ability to use knowledge and skills to effectively manage financial resources at their disposal. This in turn adds to their financial well being which adds to their performance as it promotes mental peace and self confidence. Imparting financial literacy to school going children at a basic level would help in building a strong base or a foundation which we can work upon in future. Building on that base we can explain important concepts of finances in college. This helps in financial inclusion and may work wonders for the economy of our country as well. Thus we see how financial education in its very basic form can also become a leading accelerator for the economy by promoting financial inclusion and perhaps even better household debt management.

Financial literacy comprises five basic tenets – earning, saving and investing, spending, borrowing and protecting. Earning refers to acquiring or bringing money from a job,through a business enterprises or even on return of investments. Saving and investing deals with the basic understanding and use of the several financial institutions at our disposal. It is very important that we learn that saving early solidifies the concept that saved money grows over time paving way for exploring long term investments and retirement planning in future. Spending is an important tool which reflects our personal lifestyle, values and financial behavior. Keeping an optimum balance between needs and wants helps in budgeting. Budgeting perhaps is the most consequential tool we can adopt to regulate or control spending to allow for saving and investing. Borrowing is the process of creating assets thorough acquiring debt. Students taking loans to finance their education can turn this investment in their education to their advantage with a financial plan for repayment.Protecting is about risk management - staying protected and insulated from risks at personal, health or social levels though insurance or even retirement planning.

The National Strategy for Financial Education: 2020 – 2025 recommends a “5C” approach for imparting financial education in our country. They include laying emphasis on creation of relevant Content or Curriculum in schools, colleges and training establishments, developing Capacity among organizations or institutions involved in financial services, employ a Community led model for financial education or knowledge gathering, use of proper Communication strategy to optimize the positive effects of people driven financial inclusion and lastly enhancing Co-ordination or Collaboration among various stakeholders.Any improvement in financial literacy has a profound impact on people and their ability to provide for their future. It also has a multiplier effect on the economy of our country as it helps in better risk management and critical analysis of one’s scenarios. They also have a marked influence on the well being of an individual with better social and financial security. Thus involving our students from a very basic age in the financial process helps them get a real idea of everyday life – something no one can teach them or tell them through conventional education.

Related Essays

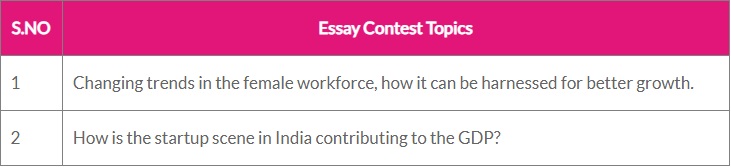

- Changing trends in the female workforce, how it can be harnessed for better growth.

- Is the caste barrier breaking due to increased love marriages in India?

- Is the caste barrier breaking due to increased love marriages in India?

- Religion Vs Nation - Write an essay on the harmony and the conflict?

- Poverty and the Indian story of the numbers below the poverty line. What are the solutions?

Top Civil Service Coaching Centers

- IAS Coaching in Delhi

- IAS Coaching in Mumbai

- IAS Coaching in Chennai

- IAS Coaching in Bangalore

- IAS Coaching in Hyderabad