The future of petrol after electric cars. Discuss the geopolitical changes it will result in.

Views: 4612

Geopolitics, as the name suggests, is the interaction between geography and

politics. Geography offers resources and politics determines who benefits.

That entails the recognition of resources. A resource is something that we want to

use and know how to use. The value and commercial status of resource changes

over time.

What was once a resource may no longer be, for example, six

decades ago asbestos was a resource but now its hazards far outweigh its

usefulness. Many people now see crude oil in the same way. Although oil has

played leading role in shaping geopolitics for more than a century, the pressing

nature of environmental issues has forced automotive companies to invest in the

widespread adoption of alternative energy for their vehicles. One such innovative

alternative option is electric vehicles. Switching to electric vehicles would reduce

greenhouse gas emissions and significantly improve the air quality, eliminate our

dependence on oil for transportation and save the taxpayers. Moreover, EVs are

safe, cheaper to operate, more efficient, and accelerate faster.

But this transition from petrol cars to electric vehicles has sparked a question- if

electric vehicles are a thing of the present or the future then what happens to

crude-oil demand in an all-electric car future? Will crude consumption will die out

or peak out and when and how the EV market will affect the geopolitical status

quo that has been so far centered on oil-producing countries?

Crude oil is the key source of energy, which is the heart of all economic activities

and growth. Land, sea and air transport, power, industries, agriculture, and even

housing are all dependent on energy. Passenger vehicles account for only one-

quarter of oil demand. Even if passenger vehicle oil demand use were to decline,

total oil demand use wouldn’t necessarily decline, if growth is seen for other

sectors. Finding substitutes for these biggest oil demand growth sectors is difficult

and costly. . According to International Energy Agency, EVs still have a long way to

go before reaching deployment scales capable of making a significant dent in the

development of global oil demand.

EVs might bring about geopolitical changes on many fronts like:

1. Access to resources.

New technologies usually require new resources that shift the global balance of

power and EVs are no exceptions. Their batteries and motors require copper,

nickel, lithium, cobalt, graphite, and rare earth metals, therefore their demand

will skyrocket which is where the real environmental and geopolitical knock-on

effects come into the picture. For example, Lithium, used in batteries for

storing electricity, is currently plentiful. Chile, Bolivia, and Brazil are currently the

top exporters of metal and Australia is home to the largest lithium reserve in the

world. But the current problem is not the raw supply but scaling the extraction

process which is currently more technically challenging than many other

metals. Similarly, cobalt, needed for the production of rechargeable batteries, is

not difficult to mine but presents a trickier set of supply chain

challenges. It is primarily found in the Democratic Republic of Congo,

a highly unstable country. Doing business in this country highly challenging and

the mining industry, in particular, has been followed by mismanagement,

corruption, and violence. This makes sourcing a major challenge for the cobalt

industry.

2. Energy security.

If electrification reduces oil demand in the future then revenue from oil would

decline in oil-producing countries, many of which are in regions already at risk

of instability. This might aggravate the problem by leading to a rise in

unemployment, internal instability, therefore, becomes a failed state. A failed

state is often home to extremist violence leading to mass migration and can have

a huge implication on the world. This potential disruption might not be confined

to Gulf. Russia is also one of the biggest exporters of gas and oil in the world and

its economy hugely depends on revenues that bring in. If oil demand decreases

then it might affect its stability and transform its relationship with Europe.

3. Trade.

The integration of international EV markets may heat trade tensions given the

potential disruption of existing industries particularly in the EU, United States, and

Japan, where car manufacturing is a significant source of jobs and growth. . Some

countries that fall behind in EVs and batteries could respond by imposing tariffs

and other barriers, resulting in trade disputes.

Finally, EVs will have ripple effects with complex geopolitical implications that are

difficult to predict. Although the adoption of electric cars will help us to achieve

the IPCC target of being carbon neutral by 2050 but can wipe out US$19 trillion in

revenue from the oil industry by 2040. That is a risk not just for oil-producing

states but for institutional investors globally, including pension funds, which

means it also poses a financial risk for consumers.

Related Essays

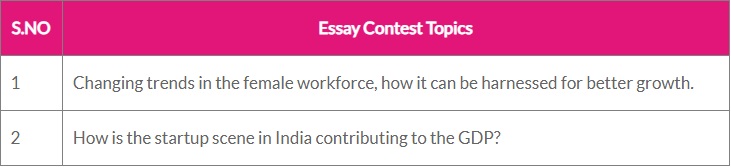

- Changing trends in the female workforce, how it can be harnessed for better growth.

- Is the caste barrier breaking due to increased love marriages in India?

- Is the caste barrier breaking due to increased love marriages in India?

- Religion Vs Nation - Write an essay on the harmony and the conflict?

- Poverty and the Indian story of the numbers below the poverty line. What are the solutions?

Top Civil Service Coaching Centers

- IAS Coaching in Delhi

- IAS Coaching in Mumbai

- IAS Coaching in Chennai

- IAS Coaching in Bangalore

- IAS Coaching in Hyderabad