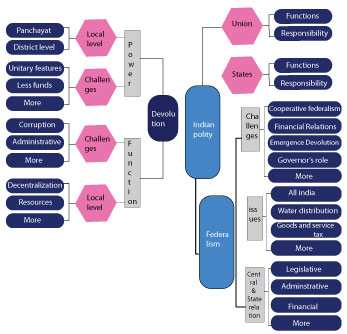

Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein

In Indian constitution, there is a dual polity with a vibrant division of powers between the Union and the States, each being best within the sphere allocated to it. The States in India are not the formation of the Centre nor do they draw their authority from the Union Government. Conversely, like the Union Government, they draw their authority directly from the Constitution and are free to operate in the field allotted to them by the Constitution. In the beginning, the Constitution of India has made most extravagant provisions about relationship between the Union and the States. This was done to reduce the conflicts between the Centre and the States. But the actual operation of the Centre-State relations for all these years has given rise to a disagreement about the understanding of arrangements made under the Indian Constitution. Knockers have expressed doubts about the existing arrangements and demanded re-allocation and adjustment of the Centre-State relations.

The centre government has control over the states through different agencies and varied techniques is mentioned below:

- Governor,

- Directions to the State Government,

- Delegation of Union functions,

- All-India services,

- Grants-in-aid,

- Inter-State Councils,

- Inter- State Commerce Commission,

- Immunity from mutual taxation.

The Constitution of India deals with Union and State executive distinctly but the provisions follow a common pattern for the Union and the States. The system of distribution of administrative powers between union and states followed in the Constitution of India in various administrative fields. In addition to the array of subject allotted in the VII schedule of Constitution, even in normal time parliament can under certain circumstances, assume legislative power over a subject falling with in the sphere exclusively reserved for the states. Beside the power to legislate on a very wide field, the Constitution confers in the Union Parliament, the constituent power or the power to initiate amendment of the Constitution.

With reference to Indian Federation, administration is primarily furnished by the state agencies. Dissimilar to the other federations where both the federal and state government create their own agencies for the administration of their laws and the subjects allocated to them in the constitution, even the laws of the union are left to be administered by the state authorities is order to avoid duplication of administrative machinery. In every federal constitution, the central and state governments are firmly enclosed and the jurisdiction of the one excludes the other. The centre is concerned with problems of the union list. The states are with matters on the state list. There is also provision for the allocation of the powers by the union to the states and vice versa.

The forte and success of such scheme requires cooperation and coordination between Centre and States. In India, the central government or the union is responsible for the governance of the whole country. There should be effective administrative norms between the union and States. The Supreme Court has demarcated that the executive power of the union is coexistence with power of the parliament, with this limitation that the executive cannot act against the provisions of the constitution or of any law made by the parliament.

The Union Government is dependent on the States to give effect to its programmes. The scheme of distribution of administrative powers has some major objectives. It arms, the union government with powers to have effective control over administration of the state and espouses several advices for intergovernmental cooperation and coordination. The executive powers in relation to any treaty or agreement has been discussed on the union by the Constitution, Parliament has also vested executive functions in union over concurrent list matters under several acts. The executive powers of the Union are assigned by the President who can exercise it directly or through officers subordinate to him in accordance with Constitution. The President has power to appoint and remove certain dignitaries in the states. He appoints the Governor of a State who holds his office during the rule of the President (Article 155 and Article 156). He also appoints judges of the high courts (Article 217) and plays a significant role in the removal of High Court Judges as also members of state public service Commission (Article 317).

The principle of federalism lies not in the constitutional as institutional structure but in the society itself. Federal Government is scheme by which the federal qualities of the society are expressed and protected. In the impact of federalizing drifts, the one party dominant system has given way to a multi Party system and elections have unfavourably affected the fortunes of major national parties, bringing to the fore some regional parties to critical separates threshold giving them heavy electoral edge. Presently, regional Political Parties have great dominance in administrative relations.

In order to form state governments by many regional parties, major national parties are under pressure to adjust their organizational structures to suit the demands of regionalization making required adjustments to the federal imperatives of the Indian polity and society.

Legislative Relations: The Union State relations in the legislative domain have been dealt by Articles 245 to 254. The Constitution evidently provides that the Parliament shall have special authority to make law for the whole or any part of the terrain of India with regard to subjects mentioned in the Union List. This list contains topics like defence, foreign affairs, currency, union duties, and communication. On the other hand, the State has exclusive power over the 66 items enumerated in the State List. This List comprises of topics like public order, health, sanitation, agriculture etc. Additionally, there is a Concurrent list containing 47 subjects like criminal law and procedure, marriage, contracts, trust, social insurance etc. over which both the Union and the State Governments can legislate.

If the law of the Union Government and the State Government clash with each other, the former succeeds. However, a State law on the Simultaneous List shall prevail over the Central law if the same had been reserved for the consideration of the President and his consent had been received before the representation of the Central law on the same subject. This clearly gives some flexibility to the States. The constitution also vests the residuary powers (viz., the enumerated in any of the three Lists) with the Central Government. It is established that in this distribution of powers, the Union Government has positively been given a preferred treatment. It has not only been granted more extensive powers than the States, even the residuary powers have been granted to it contrary to the convention in other federations of the world, where the residuary powers are given to the States.

Functions of Union:

Central executive body of the government, the cabinet performs array of functions, there its role is critical and pivotal.

These functions can be mentioned as under:

- Formulation, execution, evaluation and revision of public policy in various spheres which the party in power seeks to progress and practice.

- Coordination among various ministries and other organs of the government which might indulge in conflicts, wastefulness, duplication of functions and empire building.

- Preparation and monitoring of the legislative agenda which translated the policies of the government in action through statutory enactments.

- Executive control over administration through appointments, rule making powers and handling of crises and disasters, natural as well as political.

- Financial management through fiscal control and operation of funds like Consolidated Fund and Contingency Funds of India.

- Review the work of planning and Planning Commission.

Functions of State:

The state government is defined as the government of a country’s subdivisions and shares political power with the national government. In India, the state governments are the level of government below the central government. Each state of the country is governed by the state government.

Following are the roles and responsibilities of the state governments:

- State governments have separate departments for efficient functioning of the state. States have jurisdiction over education, agriculture, public health, sanitation, hospitals and dispensaries and many other departments.

- Internal security: The state governments have to maintain the internal security, law and order in the state. Internal security is managed through state police.

- Public order: States have jurisdiction over police and public order.

- Education: Providing a public education system, maintaining school buildings and colleges, employment of teachers, providing help to under privileged students all come under the education department of the state.

- Agriculture: The state governments have to provide support for farmers, funds for best farming practices, disease prevention and aid during disasters such as floods or droughts.

- Finances: State legislature handles the financial powers of the state, which include authorisation of all expenditure, taxation and borrowing by the state government. It has the power to originate money bills. It has control over taxes on entertainment and wealth, and sales tax.

- Reservation of bills: The state governor may reserve any bill for the consideration of the President.

- Transport: State government runs the trains, trams, bus and ferry services and other public transportation in the cities and towns of the States.

- Water supply: Water supply to cities and towns for drinking, including irrigation for farmers, is the responsibility of the State governments.

- Budget: State governments make budget for state.

Issues and challenges pertaining to the federal structure:

Federalism is a Dynamic theory of nation and state building. Political systems are categorized into federal and unitary forms of governance based on the distribution or concentration of powers between the centre and the state or in the centre respectively. The term federalism is derived from the Latin word Foedus, which according to Lewis’ Latin Dictionary means League or treaty or compact or alliance or contract or marriage contract. Federalism was first devised by the Theologians in the seventeenth century to define the system of holy enduring covenant between god and man. But later on it became related to the theories of social contract and was associated with the desire to build political society. Thus, federalism is a notion applied to a political system characterized by two levels of government deriving powers and functions from an authority which is not controlled by either level of government. The upper level of government is the national or central government and the lower level of government may be called a province or state or canton. Federalism requires understanding and negotiations between the centre and state governments in the making and implementation of strategies.

India’s political system has vast diversity through the application of the federal principle, and is broadly considered a robust parliamentary democracy. The sources of the federal idea were already present in the Government of India Act 1935, which attempted to contain rising national sentiment with the grant of limited provincial independence.

In contemporary period, federalism is a principle of understanding between two divergent tendencies, viz, the need for local autonomy and the widening range of common interests, Lord Acton. Indian federalism is unique, Unity while permitting diversity, oneness, while providing for division, a modern federalism. Federalism removes friction, stops disintegration, suppress jealousy, checks wars, and creates powerful and peace-loving nations out of a heterogeneous mass of human beings living apart and in different parts of the world.

It is recognized in studies that Federalism is based on two powers one is regional and one is central power. Regional power is related with a particular region and it has its well defined list of powers. Central power is linked with whole country and it also has its own list of powers which in case of India is more powerful. In India, Federalism is based on the cooperation between States and Union. In Indian context, concept of federalism is that each region has its own demand which needs to be better fulfilled by the regional government but there are many areas which are common for whole country which needs to be governed by union government. Most notable feature of the Indian Constitution is its federal structure, together with a form of unitary government with a dual polity and a single set of rights and obligations. Basu stated that “Indian Constitution is partly rigid and largely flexible”.

Issues between the Centre and the States:

- Dominance of the Congress Party

- The Role of the Governor (Discretionary Power and Appointment Issues)

- Reservation of Bills for Consideration of President

- Misuse of Article 356

- The Maintenance of Law and Order in States

- Encroachment by the Centre on State List

- The Financial weakness of the State

- Taxation Powers

- Issue of Grants

- Role of Planning Commission

- Question of Autonomy Issue

1. Dominance of the Congress Party:

There were two phases in history so far as the Union-States conflicts are concerned. The first phase which finished with the Fourth General Elections in 1967, was marked by the supremacy of Congress party in Centre as well as on the States. Consequently, the Union-State conflicts were a matter of internal problem of Congress Party and resolved at that level only. The post 1967 political situation witnessed as the emergence of non-Congress Governments in the States as well as in the Centre. Now the internal mechanism of the Congress party could not resolve the conflicts and they not only came to the surface but also became progressively intensive.

2. The Role of Governor and Discretionary Powers of Governor:

The Governor is appointed by the President of India for five years. But he remains in the office till the pleasure of the President. It means, he can be recalled any time and his continuation in the office depends at the will of the Centre. The Supreme Court has held that the Governor’s office is an independent office and neither it is under control nor subordinate to the Government of India. However, a study of Governors in the States clearly exposes that most of them have been active politicians before becoming Governor and the rest were bureaucrats. They are appointed on political basis and therefore hardly expected to play a non-partisan role. It is the Governor’s biased role that has been the centre point in Union-State skirmishes. The Governors have advanced the political interests of the ruling party of the Centre in the States. This has been done most remarkably in the appointment of Chief Ministers, summoning, proroguing and dissolving the State Assemblies and in recommending President’s rule.

Besides the normal functions which Governor exercises as a constitutional head, he exercises certain discretionary powers. Some of them have been particularly conferred on him while some others flow by necessary implication. These are significant particularly in this matters. One is with regard to the appointment of Chief Minister when neither a single party nor a combination of parties emerges from the election with a clear majority. In this situation, there is a question of dismissal of Chief Minister on the loss of majority support or otherwise. The second matter is with regard to making a report to President under Article 356 about this satisfaction that a situation has risen in which the Government of the State cannot be carried according to the provisions of the Constitution. Thereby recommending the imposition of President’s rule, the issue of declaration of President’s rule itself has become a matter of serious tension between union and state governments.

3. Reservation of Bills for Consideration of President:

According to the Article 200 of the Constitution, certain types of bills passed by the State legislature may be reserved by the Governor for the consideration of the President. The President may either give his acceptance or may direct the Governor to send it back for reconsideration by the State legislature along with his comments. But even after the bill has been passed by the State legislature for the second time, the President is not bound to give his assent. The main purpose of this provision is that the Centre can observe the legislation in the national interest. But Governors, and through them the central Government have used this provision to serve the partisan interests. The opposition reigned States have from time to time raised a tone and shout against the misuse of these provisions. This has specially been in case where the Governor has reserved a bill against the advice of the State Ministry. Presumably under the direction of the Central Government. In its memorandum to Sarkaria Commission, the Bharatiya Janata Party alleged that the bills have been reserved for consideration of the President in order to create difficulties for the State governments. The West Bengal government in its reply to the Sarkaria Commission ‘s questionnaire felt that Articles 200 and 201 either should be deleted or Constitution should clarify that the Governor would not act in his discretion but only on the advice of the State Council Ministers.

4. Misuse of Article 356:

Article 356 is the most contentious article of the Constitution. It offers for State emergency or President’s rule in State if the President, on receipt of report from the Governor of a State or otherwise, is satisfied that a situation has risen in which the Government of the State cannot be carried on in accordance with the provisions of the Constitution. The duration of such emergency is six months and it can be extended further. In the Constituent Assembly, Ambedkar had made it clear that the Article 356 would be applied as a last option. He also hoped that “such articles will never be called into operation and that they would remain a dead letter.”

5. Emergency Provision:

Article 356 should be used very carefully, in extreme cases, as a matter of last resort. A warning should be issued to the disturbed State in specific terms, alternatives must not ordinarily be dispensed with. It should be provided through proper amendment that nevertheless anything in clause (2) of Article 74 of the Constitution, the material facts and grounds on which Article 356 (1) is appealed, should be made an integral part of the proclamation issued under the Article. This will also assure the control of the Parliament over exercise of this power by the Union Executive, more effective.

Devolution of powers and finances up to local levels and challenges therein:

Formation of self-governance at the local level can only be accomplished by meaningful and effective devolution of functions, funds and functionaries (3Fs) to the PRIs. Progress in this direction was in fits and starts. There was inequality in the devolutions made between States and within States in sectors of development. The transfer of funds and functionaries did not match decentralizations. Government of India Ministries did not also reorient their Centrally Sponsored Schemes to provide a dissimilar role for local bodies. However, gradually these inadequacies are being attended to.

To observe this matter which is slow pace and prevalence of wide disparities, attempts are being made to build agreement and a series of conferences and round tables with the Centre and States participating have been organized. Major objectives are, to ensure that there is role clarity between various levels of Government including local bodies through ‘activity mapping, to match funds with functions and to show them clearly in the budget, to ensure that plans are prepared at each level which are then consolidated at the district level, to strengthen the capabilities of local bodies to enable them to manage their affairs and to deepen the accountability of local bodies to citizens and review of their activities by Gram Sabhas.

In the present development situation, the local self-governing institutions in rural India has a crucial role in the implementation of development programmes. These institutions have become instrumental in designing development plans for rural areas and implementing such programmes in keeping the available fiscal and human resources in mind. The 73rd Amendment Act of the Indian Constitution has extensively purveyed a set of legitimate powers to these institutions, with a stately objective to develop them as institutions of self-government. Therefore, the powers and functions categorised for these institutions under the purview of the Indian Constitution have clearly pronounced the significance of these institutions. However, the current trend of functioning of rural local self-governing institutions in India provides a miserable scenario because of their failure to handle critical human development issues.

Despite the presence of a advanced governance system such as the Panchayati Raj, the rural provinces in India still face severe human development challenges. It is contended that the decentralised governing institutions can provide a responsible and transparent administration only when certain internal and external conditions like accountability, transparency, participation and fiscal transfers will be taken into consideration. The Indian Constitution under its federal character has provided plentiful provision for sharing the powers between the centre and the states as well as between the states and the local governing institutions (both at rural and urban level). Centre-State economic relation has provided range of the sharing powers for revenue generation, taxation and expenditure of revenue under the framework of the Indian Constitution. However, the legitimate progression of the local self- governing institutions since 1992 (73rd Amendment) has forced the policy makers to re-examine the constant power sharing mechanism between the centre and the states in India.

It is believed that, the local self-governing institutions under the Indian federal polity enjoying such residual powers which are discussed by the state legislatures. The power sharing exercise between the states and the local level of governments in India provide a dissenting situation. Especially the fiscal power conferred to the PRIs, often question the issue of rationalisation in power devolution ground, and thereby provide a platform for the academic robustness. The local self-governing institutions in India have evolved through a series of historical events, rules, regulations, acts and commissions, and have finally reached a revival stage in the form of the 73rd Amendment Act (1992) and the PESA Act (1996). It is debated that the political and economic theories of decentralisation have developed over a period of time, and have paved the way for institutionalisation of decentralised governing institutions in India. However, the functioning of the local self-governing institutions in India has faced challenges, which are acute in the case of the financial transfers. Such challenges troubled the functioning of these institutions. Further, Politicisation of local democracy and the existence of structural impediments to the effective functioning of local self-governing institutions emboldens the supremacy of the local elite in these institutions. Therefore, devolution of fiscal powers to the PRIs has provided unproductive results. The issues of fiscal independence of these institutions can be seen writ large, notwithstanding the recommendations of the central and the state finance commissions in that regard. Such situation has hindered the spirit of “self-governing institutions” by decreasing their functions as “implementing agencies” of government. In the framework of the shifting political scenario, party system and appearance of structural readjustment since 1991, the macro-economic scenario has been going through a changeover phase. This scenario also paved the way for a fresh analysis of fiscal devolution to the PRIs.

Local Self-Governing Institutions and Fiscal Devolution in India-A Historical Analysis:

Democratic decentralisation in India has a robust historical background, the stages of evolution, revival and growth starting from the ancient Vedic civilisation (1200 BC) to modern India. The notion of “self -rule” in rural India succeeded during the ancient period in the name of “ sabhas” which were the strong grounds for making “participatory community based decisions of self-rule” by the designated traditional village head or a group of heads. The Panchayats had both executive and judicial powers, including the power to decide land revenue, village administration and providing taxes to higher administrative bodies. According to Mathew (1994), the important characteristics of these Panchayats were (during ancient period) that they had been the hinge of administration, the centre of social life, an important economic force and a focus of social solidarity.

Nonetheless, when the British rule was dominated, the government’s policy towards uplifting the panchayatiraj institutions in India, to institutions of self-government, was not impressive and commendable. During this period, administrative and fiscal centralisation was a colonial requirement. At the same time, the difficulty of administering a large country with a number of principalities, different languages, cultures and traditions did force the central government to devolve some powers to regional units (Rao, 2000). Conversely, till the country’s freedom, several policy measures were introduced by the British Government, including the government of India Acts 1919 and 1929, which paved the way for strengthening decentralised Governance in pre-independent India. The Government of India Act, 1935 pronounced the period of federalism by adding the conception of “Quasi -Federalism” (Rao, 2000).

Local Self-Governance and Fiscal Decentralisation during Post-Independence Period:

In the era of the post-independence, the Indian constitution embraced the Panchayat Raj system as a part of the “directive principles of state policy” in an effort to decentralise the administrative powers to the grassroots. However, at the same time, the constituent assembly adopted a federal structure with an intention to create a strong centre. Johnson (2003) stated that the most permanent image of decentralisation in India has been Gandhi’s vision of village swaraj, in which universal education, economic self-sufficiency, and village democracy would take the place of caste, untouchability and other forms of rural exploitation. But till 1992, the Panchayati Raj Institutions in India had no authentic powers because of centralised character of the Indian federalism, which called for strong union, centralised planning and programs for economic development. Rao (2000) stated that Indian federalism officially evolved as a two-tier structure until 1992. However, local government units existed both in rural and urban areas, which basically acted as agencies of the state government. In spite of the presence of state specific initiatives in states such as Kerala, West Bengal, Karnataka and Odisha, the Panchayati Raj institutions continued in a dormant stage till 1992. This was due to different factors like insufficient powers, poor finances and lack of political determination. The important constituent of federalism i.e. fiscal federalism which is based on assignment of satisfactory revenue powers to local level of governments scarcely existed in many states.

The 73rd Amendment Act: The 73rd Constitution Amendment Act offered push to the LSGs in India by devolving requisite powers & functions, which are political and economic in nature. Proponents of decentralised governance in India contended that the 73rd Constitution Amendment Act has ushered a greater degree of uniformity in structure(Three-tier), Composition (reservation for SCs,STs and women), powers and functions(financial and planning), of these institutions with an objective to achieve faster social and economic development.

The important features of the act which pronounced the greater financial autonomy to the PRIs in India:

Devolution of powers including fiscal power: Devolution of powers including fiscal power to the PRIs is the most noteworthy aspect that mirrored through the 73rd Constitution Amendment Act. It was advocated that the functions of 29 subjects under the 11th Schedule of the Indian Constitution will be devolved to the PRIs to ensure effectiveness in functional aspects. Nonetheless, the current trend of power devolution to the PRIs has provided a gloomy scenario because of the failure of different states in this regard, particularly with respect to the devolution of fiscal powers.

It is assessed that the 73rd Amendment to the Indian Constitution has appropriately provided fiscal powers to the local self-governing institutions to make them more efficient and responsible. The act has also provisioned for the constitution of State Finance Commissions in the states to scrutinize the fiscal scenario of the local governments and suggest suitable recommendations to the state to that extent. However, after two decades of enactment of 73rd Amendment, the fiscal positions of PRIs in different States highly frenzy and unbalanced in nature. The problem of fiscal decentralisation presents two broad situations, policy failure or failure of state governments and failure of the local governments.

It is contended that fiscal decentralisation is the fiscal empowerment of the lower tiers of the government and involves the devolution of their taxing and spending powers along with the arrangements for remedying mismatches in resources & responsibilities (Oommen, 2006). However, the current fiscal power devolution to PRIs in India has been providing two broad areas in which the problems are predominant.

Policy failure: Rao (2011) contended that vital feature of a successful system of fiscal federalism is the task of adequate revenue powers to sub-national governments that forge a strong link between revenue and expenditures at the margin. However, experience from different states exposes that, the fiscal devolution process has been more or less confined to the mere delegation of authority without devolving powers of taxation and revenue generation. Failure of the states to decentralise the desired fiscal powers to the local-level governments slowly turned these institutions to extended wing of the state governments. It has been observed in the case of fiscal devolution, that there was fiscal delegation in different states, without devolving powers; this has severely affected the fiscal position of the PRIs. There is no tool devised to assess the potential source of revenue of the PRIs, and therefore no mandatory targets have been set in this regard.

Failure of the Local Governments: The 73rd and 74th amendments (for urban local bodies) have made India the largest democratic establishment with huge representative base in the world. There are 2.5 lakhs local governments in India with 3 million representatives, which itself demonstrations the massiveness of the Indian Democratic setup (Oommen, 2010). Nevertheless, the extent of fiscal autonomy enjoyed by these institutions, in the context of spending and generating revenues, clearly establish their role in the current development scenario. The PRIs in major Indian states, have been unsuccessful to utilise the potential revenue generation source, because of their over dependent nature and the serious capacity gap. Additionally, improving the revenue is mainly linked to two major factors that include appropriate redesigning of fiscal transfer system and proper institutional arrangements; both are lacking in the case of PRIs.

Major Challenges:

Confusing power devolution schedule: The critical factor that crippled the fiscal autonomy of the PRIs is the imperfect process of power devolution to the PRIs by different state governments. While states such as Kerala, West Bengal, Karnataka and Madhya Pradesh have devolved the desired powers to the PRIs, other states such as Odisha and Jharkhand are lagging behind in the process. A study conducted across Andhra Pradesh, Gujarat, Kerala, Madhya Pradesh, Maharashtra, Tamil Nadu, Odisha, Punjab, Haryana, Assam and Goa also revealed that most states granted several functional responsibilities but there was no executive follow-up of granting passable powers, staff and additional financial resources (Fernandes, 2003).

Poor budgetary allocation: Fiscal devolution depends on the expenditure responsibilities and revenue assignments devolved to the lower tiers. However, experiences from different States shows that, the fiscal allocations to the PRIs have deteriorated severely which has restricted their development agendas (Oommen, 2006).

Tax Decentralisation and the role of SFCs: In most states, the reports regarding the recommendations of the SFCs were not taken into account which is another grey area in fiscal decentralisation. Economic intellectual argued that the PRIs should have the right to collect taxes from private taxpayers (Marjeet, 1999) which is not reflected in States’ tax decentralisation agenda.

Fiscal Dependency: It is debated that financial decentralisation leads to fiscal dependency of the PRIs over central and state hierarchies. This scenario has led to the fiscal inadequacy of the PRIs by reducing their role as mere implementer of government programs. For the implementation of different programs the PRIs have to wait for “sanction orders” from upper level government departments, which hamper the timely and effective implementation of development programs.

Gap in coordination: One of the most important requirements for efficient fiscal federalism is clarity in the assignment system. Not only should the assignment system be clear as far as possible, but when there is coinciding, there should be systems and institutions in place to resolve it (Rao, 2011). However, in the case of PRIs, the intra and inter institutional coordination gap is also seen in the process of transferring funds to the PRIs, which is another challenging part in fiscal decentralisation. The flow of funds from higher to lower tiers has become burdensome affair because of unnecessary delay, technical incompetency and an attitude of arrogance.

To summarize, the Structure of Indian constitution deals with Union and State executive distinctly but the provisions follow a common pattern for the Union and the States. The system of distribution of administrative powers between union and states followed in the Constitution of India in various administrative fields. The Union Government is reliant on the States to give effect to its programmes. The system of distribution of administrative powers has two objectives. It enables the union government with powers to control over administration of the state and at the same time it espouses several advices for intergovernmental cooperation and coordination (Sarkar RCS, 1986).