Money Laundering and Its Prevention

India is extensively gripped under crime of money laundering. Money laundering is usually used by criminals to hide money made through illegal act. It is the process by which huge amount of money obtained unlawfully, from drug trafficking, terrorist activity or other severe crimes. Money laundering has an unfavourable impact on economy and political steadiness of nation. It is necessary that all nations of the world must jointly device policies and adopt measures to curb act of money laundering by resorting to forceful enforcement of law.

Generally people consider Money laundering is the conversion of black money into white money. This takes one back to cleaning the huge piles of cash. If it is done successfully, it allows the criminals to maintain control over their proceeds and ultimately to provide an authentic cover for their source of income. Money laundering fulfils the ambitions of the drug trafficker, the terrorist, the organized criminal, the insider dealer, the tax evader as well as the many other groups who need to avoid the kind of attention from the authorities that unexpected prosperity comes from illegal acts. These criminal tries to get money and power through criminal activities and then attempt to penetrate the legitimate society, thereby misrepresenting the terms of the compact. They create huge amount of money for the members of the enterprise and permit their associates to live extravagant lifestyles.

Concept of Money Laundering: Money laundering is designated as the source of illegally obtained funds covered through a series of transfers and deals in order that those same funds can eventually be made to appear as legitimate income (Robinson). According to Interpol General Secretariat Assembly in 1995, money laundering is any act or attempted act to conceal or disguise the identity of illegally obtained proceeds so that they appear to have originated from legitimate sources.

Money Laundering is an expression that has recent origin. Money laundering is a cultured crime that is not to be taken seriously by society. When comparing with street crimes, it is a modern crime. Some experts refer to it as a victimless crime but in reality, it is not a crime against a particular individual, but it is a crime against nations, economies government, rule of law and world at large. Money laundering has become a worldwide threat. The objective of a huge number of criminal acts is to get profit for the individual or group that performed the act and then hide either the source or the purpose of cash. Money laundering is the processing of these criminal proceeds to cover their illegal origin. This process is very crucial for government and other responsible authorities as it enables the criminal to enjoy money obtained from illegal source. Some of the crimes such as illegal arms sales, smuggling, corruption, drug trafficking and the activities of organized crime including tax evasion produce huge money. Insider trading, corruption and computer fraud schemes also generate more profits and create the incentive to legitimize the illegal gains through money laundering. When a criminal activity produces large profits, the individual or group involved must find a way to control the funds without attracting attention to the original activity or the persons involved. Criminals perform this by disguising the sources, changing the form, or transferring money to a place where they are less likely to attract attention. Otherwise, they will not be able to use the money because it would connect them to the criminal action, and law enforcement authorities would grab it. If criminals perform this process successfully, it allows the criminals to maintain control over their proceeds and eventually to provide a legitimate cover for their source of income. Where criminals are allowed to use the proceeds of crime, the ability to launder such proceeds makes crime more attractive.

Significance of Money Laundering: Money laundering is an important criminal issue for policy makers and government authorities that gained increasing significance after the occurrence of heart throbbing indents of 9/11 attack on the twin towers in the U.S. After that all nations has focused its attention on the notion of money laundering and has recognized it as a source of the funding of terrorist actions. The process of globalization and advancements of the communications have made crime increasingly international in scope, and the financial aspects of crime have become more complex due to technology enhancement. The huge expansion of international banks all over the world has facilitated the transmission and the disguising of the origin of funds. This may have shocking social consequences and poses a threat to the security of any nation at large or small scale. It offers immense facilities for drug dealers, terrorists, illegal arms dealers, corrupt public officials and all types of criminals to operate and increase their criminal activities. Laundering enables criminal activity to continue. Money laundering causes an alteration of resources to less productive areas of the economy which in turn deceases economic development. If security authorities and government ignore this crime, there will be serious consequences on social and political development of nation. The economic and political influence of criminal organizations can deteriorate the social fabric, collective ethical standards, and eventually the democratic institutions of civilisation.

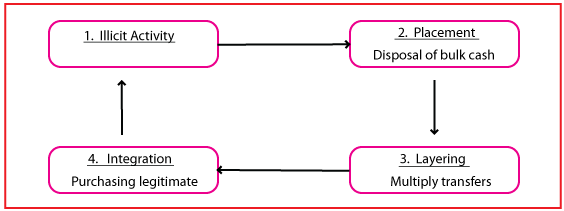

Theoretical review of money laundering: It has been demonstrated in academic reports that financial institutions have made efforts to detect and prevent money laundering since last many years, but the main feature of money laundering are its processes in which it is carried out. Many experts have argued that money laundering does not take a singular act but takes a more complex operation, which is completed in three basic steps which include placement, layering and integration (Anon, 2006). The International Monetary Fund (IMF) (2001: 7-8) defined money laundering as being the "transferring (of) illegally obtained money or investments through an outside party to conceal the true source". In South Africa, the Public Accountants and Auditors Board (2003), stated that money laundering is defined in local legislation as being "virtually every act or transaction that involves the proceeds of crimes, including the spending of funds that were obtained illegally". There are variation in views of different authorities to explain the notion of money laundering.

Processes of Money Laundering

Placement: First step is the Placement stage in the money laundering cycle. Money laundering activities is usually generated from cash intensive business, large amount of cash or hard currency and grown from illegal activities such as sale of drugs, illegal firearms, prostitution or human trafficking. Currencies gained from this cycle need to be disposed of immediately by the launderer, so they go as far as depositing it back in financial institutions, spending in retail economy, and involvement in a business or acquisition of an expensive property/asset or smuggled out of the country. The launderer's intention in this stage is to eliminate the cash from the place of possession so as to escape any form of detection from the authorities and to transform it to other form of assets such as travellers' cheques. Temple (2002) delineated some of the more common ways in which placement could be achieved, such as exchanging currency for smaller denominations that will make it easier to utilise, transport or conceal to methods involving the use of multiple deposits entailing small amounts in different bank accounts. Nixon (2000) refers to the practice of utilising multiple deposits being placed in many accounts by different individuals as "smurfing". Moulette (1995) recognised other strategies such as use of representative offices of foreign banks, international "houses" or "sub accounts" that may be maintained by banks on behalf of their clients for the funnelling of funds through casino's or unregulated Asian games such as Pai-Gow.

Layering: In this stage, the launderer tries to hide or disguise the origin of the funds by creating complicated layers of financial transactions designed to cover the audit trail and conceal it. Banerjee (2003) stated that layering serves to hide the source and ownership of the funds. Moulette (2000) suggested the methods used to accomplish layering such as the use of offset accounts by dealers, online electronic fund transfers between certain tax havens, and doubtful gold transactions in which large purchases of gold in countries with low VAT rates and then (there is an) exporting (of) the bullion back to the country of origin". The aim of layering is to separate the illegal duties from the source of the crime, layers upon layers of transactions are created, moving illegal funds between accounts or business, or buying and selling assets on a local and international basis until the original source of the money is undetectable. Suter (2003) designated that there are other methods that can be adopted to allow, layering to take place that involve the over-invoicing and false invoicing of imports and exports.

Integration: After the layering stage, illegal funds are taken back into the financial system as payments for services rendered. Making the launderer feel fulfilled by making the funds appear to be legally earned. Illegal funds is returned to the economy and disguised as genuine income. Schroeder (2001) indicated that the techniques adopted to successfully integrate funds from a criminal enterprise would very often be similar to that of practices adopted by legitimate business.

Basic steps of money laundering: (Source: Georgios Boustras, 2012 )

Impact of money laundering on nation: There are many dangerous impact of money laundering on country as well as whole world. According to McDowell and Novis (2001), there are following key effects of money laundering:

- Undermining of the legitimate private sector: Quirk (1997 : 7-9) stated that The use of front companies by money launderers undermines the legitimate private sector, as the motive of money launderers is not necessarily to make a profit out of operations of the front company.

- Undermining of the integrity of financial markets: The succeeding reputational loss by financial institutions results in a loss of confidence by consumers in these affected financial institutions who may be perceived to be involved in fraudulent activities. This could also affect the reputation of a country and force investors to invest in economies that are perceived to be less exposed to the risk of money laundering. Money laundering can deleteriously impact on the truthfulness of financial markets, and also weaken the reputation of a nation.

- Loss of control of economic policy: Reports of IMF (2003) signified that the size of the funds being laundered, and the fact that money launderers would want to launder their funds through developing economies to reduce possible detection of their schemes, can affect the inflow and outflow of funds in these countries.

- Economic distortion and instability: Money laundering may also misrepresent capital flows, and thus destabilise the effective functioning of the world-wide economy. Castle and Lee (1999) argued that money launderers would not look at where to best invest their money based on economic principles, but rather at where it would be easier to avoid being caught or based on where the cost of avoidance was lower.

- Loss of revenue: Many theorists such as Kovacevic (2002) and Fundanga (2003) stated that money laundering decreases the tax funds available for collection in the economy and by implication government's revenues. Consequently, governments may have to levy higher taxes in order to obtain the funds necessary to fulfil their responsibilities towards their citizens.

- Security threats to privatisation efforts: According to Chossudovsky (1999), it was observed that money launderers who are able to obtain previous government entities that are being privatised, can attempt to establish a legitimate front to launder funds. This can weaken economic reforms as money launders are not interested in operating these entities as going concerns, but rather as a channel for laundering money.

- Reputation risk: Van Fossen (2003) asserted that nations that are competing as destinations for legitimate investments may face difficulty to do so if there is a perception that the country has a poor track record of dealing with money laundering or is seen to be a centre for money laundering. This is because legitimate investors are wary of being associated with any country that has a negative reputation.

Other impacts of money laundering are as follows:

Increased criminality: The increase in criminality is serious effect and a matter of concern in money laundering. The triumph of money launderers is the distance they create between themselves and the criminal activity producing profit, so that they can live lavish life could through this crime without attracting attention and could also go to the extent of reinvesting their profits to finance other crimes. Therefore, government, legislative act and other enforcing laws must implement policies in legal procedure to curb the crime.

Social effect: Committing crime of money laundering transfers of economic power from the right people to the wrong. The good citizens and the government are dispossessed from their right, making the criminals take the benefit to flourish in their criminality. Money laundering damages the financial institution which is an important factor in the economic development of nation.

In developing countries where there is no strict control, the governments have to seek further contribution from good citizens, making people suffer more and continue to be subject to poverty. Companies cannot compete with operators financed by illegal funding, labours then become jobless and the high rate of unemployment result in an increase in criminality, dissatisfaction and insecurity. The burden on the government would then increase with the need to provide security therefore reallocating resources from more productive enterprise to other areas. This reduces productivity in the real sector of the economy by diverting resources from productive areas to social sectors; crime and corruption which are on the increase would then slow down economic growth and decrease human development.

Microeconomics effect: Money launderers generate and make use of companies that front for them. These companies are not interested in and but pretend to be involved in them. Usually the companies are not doing any serious business. The income generated from the company is not usually from the business but from their criminal activities. Their decisions are not usually based on economic considerations and would offer products at prices below cost price making the front companies have an unjustified competitive advantage. Legitimate businesses lose when competing, as there is no fair competition involved and results in business closures due to crowding out effect of private sector business by criminal organisations.

Macroeconomic effect: There are numerous impacts of money laundering on the macroeconomic situations. These include volatility in exchange rates and interest rates due to unanticipated transfers of funds; fall in asset price due to the disposition of laundered funds; misallocation of resources in relative asset commodity prices arising from money laundering activities; loss of confidence in markets caused by insider trading, fraud and embezzlement. When businesses make less revenue and pay fewer taxes, people become unemployed and dependent on social assistance which is most times difficult to get in developing countries. When criminals use financial institution for laundering funds, this creates negative promotional and it's enough to scare banks into striving to keep criminals away from their terrain. Also banks have a risk of performing a balancing act between attracting new business and complying with the regulations and legislations. The securities markets (especially derivatives) have become the attention of money launderers and are posing an added risk to financial systems. Other indirect economic effects are higher insurance premiums for those who do not make fraudulent claims and higher costs to businesses therefore generating fewer profits which make it difficult to break even. According to Reilly (2008), money laundering has the ability to infiltrate the global financial system and also change economic data. Quirk (1997) in Reilly et al (2008) stated that money demand can appear to change from one country to another resulting in deceptive financial data. Income distribution also tends to be affected by money laundering because it could be redistributed from high savers to low ones, sound investments to risky ones. Due to such negative impact, policy makers have to face difficulty to devise effective responses to monetary threats and it causes difficulties in the government efforts to manage economic strategy. Sensible risks are prone to affect the reliability of banks and the management of economic policies. The prudential risk might be as a result of the corruption of the bank manager, when he/she begins to accept large sum of money from launders and this brings about non-market behaviour in the financial system. Steel (2006) affirmed that financial institutions are regarded as organizations that provide financial services to its customers or members, leaving them at the front position in the battle against money launderers. Financial institutions are not the only target the launderers use in their various schemes but they are accountable for financial dealings and for reporting any doubtful transactions.

It has been cleared that the Money laundering has negative consequences on monetary development. Money laundering constitutes a serious risk to national economies and respective governments. The penetration and sometimes saturation of illicit money into legitimate financial sectors and nations accounts can intimidate economic and political constancy. Economic crimes have a disturbing effect on a national economy since potential victims of such crimes are far more numerous than those in other forms of crime. Economic crimes also have the potential of unfavourably affecting people who do not prima-facie, seem to be the victims of the crime. For example, tax evasion results in forfeiture of government income and in turn affecting the potential of the government to spend on development schemes thereby affecting a large section of the population who could have benefited from such government expenditure. A company fraud not only results in cheating of the people who have invested in that company but may also adversely affects investors' confidence and eventually the development of the economy. Legislature body has difficulty to quantify the negative economic effects of money laundering on economic development. Such activity damages the financial-sector institutions that are critical to economic growth, reduces productivity in the economy's real sector by diverting resources and encouraging crime and corruption, which slow economic growth, and can distort the economy's external sector international trade and capital flows to the detriment of long-term economic development.

The Financial Sector: Financial sector may get negative effects of money laundering particularly financial institutions including banking and non-banking financial institutions and equity markets, may directly or indirectly be affected. Basically, these institutions facilitate concentration of capital resources from domestic savings and funds from overseas. These institutions provide impetus to furtherance of investment prospects by providing conducive environment and efficient allocation of these resources to investment projects which contributes substantially to long run economic growth.

Reports signify that Money Laundering weakens the sustainability and development of financial institutions in two ways.

Firstly, the financial institutions are debilitated directly through money laundering as there seems to be an association between money laundering and fraudulent activities undertaken by employees of the institutions. Likewise, with the rise in money laundering acts, major parts of financial institutions of a state are susceptible to crime by criminal elements. This strengthens the criminals of money laundering channels. This may lead to the removal of less equipped competitors and giving rise to domination.

Secondly, customer trust is important to the development of comprehensive financial institutions, and the perceived risk to the growth of sound financial institutions, and the perceived risk to depositors and investors from institutional fraud and corruption. The Real Sector Money laundering harmfully affects economic development through the real sector by diverting resources to less productive activities and by facilitating domestic corruption and crime.

Money laundering also performed through the channels other than financial institutions that includes more sterile investments such as real estate, art, antiques, jewellery and luxury automobiles, or investments of the type that gives lower marginal productivity in an economy. These sub optimal allocations of resource give lower level of economic growth which is a serious disadvantage to economic progress for developing countries. Criminals invest their proceeds in companies and real estate in order to make further profits, legal or illegal. Most of these investments are in sectors that are familiar to the criminal, such as bar, restaurant, prostitution. The real estate sector is the largest and most susceptible sector for money laundering. Real estate is important for money laundering, because it is a non-transparent market where the values of the objects are often difficult for approximation and it is an efficient way to place large amounts of money. The price increase in real estate is lucrative and the annual profits on real business create a legal basis for income. The real estate has the following characteristics for criminal money:

- A safe investment

- The objective value is difficult to assess.

- It allows to realize "white" returns.

The External Sector: Money laundering activities may weaken the financial growth of any nation through the trade and international capital flows. Excessive illegal capital flight from a state may be facilitated by either domestic financial institutions or by foreign financial institutions. That illicit capital flight drains scarce resources specially from developing economies. In this way, economic growth of corresponding economy is adversely affected. Money laundering negatively affects trust of local citizens in their own domestic financial institutions as well as trust of foreign investors and financial institutions in a state's financial institution which ultimately contributes to economic growth. Money laundering channels may also be related with distortions of a country's' imports and exports. As with the participation of criminal elements on the import side, they may use illegal proceeds to purchase imported luxury goods, either with laundered funds or as part of the process of laundering such funds. Such imports do not produce domestic economic activity or employment, and in some cases can theatrically reduce domestic prices, thus reducing the productivity of domestic enterprises. The reliability of the banking and financial services market place depends mainly on the perception that it functions within a framework of high legal, professional and ethical standards. A reputation for integrity is most valuable assets of a financial institution. Dangers for the reputation can happen when a country purposely declares to want to attract 'criminal money. If funds from criminal activity can be easily processed through a particular institution, either because its employees have been bribed or because the institution do not pay attention to the criminal nature of such funds, the institution could be drawn into active complicity with criminals and become part of the criminal system itself. Such network will damage the attitudes of other financial intermediaries and of regulatory authorities as well as ordinary customers.

Money laundering has other dangerous consequences also. It not only impends the financial system of nation by taking away command of the economic policy from the government, but also declines the moral and social position of the society by exposing it to activities such as drug trafficking, smuggling, corruption and other criminal activities. The Global Sector Money Laundering has become a world-wide problem. Criminals target foreign authority with liberal bank secrecy laws and feeble anti-money laundering regulatory governments as they transfer illegal funds through domestic and international financial institutions often with the speed and internet transactions. This huge penetration of criminal proceeds into world market can destabilize and can have a debasing effect on those who work within the market system. The infiltration of criminals into the genuine markets can also change the balance of economic power from responsible and responsive entities to scoundrel agents who have no political or social responsibility.

Prevention and Combat Of Money Laundering

Legislators around the world have realized that concentrated efforts are required to deal with illegal funding and control money laundering.

India has different laws to tackle smuggling, narcotics, foreign trade violations, foreign exchange manipulations and also special legal provisions for preventive detention and forfeiture of property, which were enacted over a period of time to deal with such severe crimes. Some of these were considered to be strong measures, but may not now match the post-Sept.11 measures initiated in the US and the EU. In India, there were old age practices for prevention of Money laundering in the sense of seizure and repossession of proceeds of crime. The statutes predominant before the Prevention of Money Laundering Act, 2002 (Money Laundering Act of 2002) are:

- Criminal Law Amendment Ordinance (XXXVIII of 1944).

- The Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976.

- Narcotic Drugs and Psychotropic Substances Act, 1985.

- Criminal Law Amendment Ordinance (XXXVIII of 1944): Under this law, police can get the proceeds of crime relating to bribe, breach of trust and cheating confiscated by an order of attachment and on completion of the criminal prosecution can get an order from court forfeiting the proceeds. This ordinance was modified in 1946 and responsibility of proof to the accused. In the event of crime under Prevention of Corruption Act, the implementation rests with the CBI. However this law covers proceeds of only certain crimes such corruption, breach of trust and cheating and not all the crimes under the Indian Penal Code.

The Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976: According to this law, there is a penalty of illegally acquired properties of smugglers and foreign exchange manipulators and for matters connected therewith and incidental thereto. The application of this law is restricted to the persons convicted under the Customs Act, 1962 or Sea Customs Act, 1878 or other foreign exchange laws. Under this Act, no person shall hold any unlawfully acquired property either by himself or through any other person on his behalf. The word 'illegally acquired property' has been well defined under section 3(c) of the act.

There is very broad legislation in India on money laundering which includes all kinds of laundering of money relating to all crimes and offences under laws of India except offences relating to drug trafficking or offences under Indian Penal Code. As far as drug offences are concerned, prevention of money laundering is taken care of by Narcotic and Psychotropic Substances Act, 1985.

- Narcotic Drugs and Psychotropic Substances Act, 1985: Narcotic Drugs and Psychotropic Substances Act, 1985 provide for the penalty of property derived from, or used in illegal traffic in narcotic drugs. Sections 68A to 68Y of Chapter VA of the Act provides for forfeiture of assets derived from or used in unlawful traffic. The provisions are so broad that the authorities administering the law have huge powers including the power to trace the source of drug related money or property and afterward to proceed with freezing of accounts and seizure of property and forfeiting it to the government.

Other analogous statutes: Besides these legislations, there is a law of Foreign Contribution (Regulation) Act, 1976 under which the Central government regulates flow of funds to various organizations. If the Central government thinks any organization is acting against national interest, it can block its funds. Further to that Reserve Bank of India, which administers Foreign Exchange Management Act, 1999 has powers under section 11 of the Act to give appropriate directions to the authorized dealers to prevent violation of any laws. In addition to above Section 102 and Sections 451to 459 of the Code of Criminal Procedure, 1973 enables seizure and confiscation of the proceeds of crime.

The purpose of the Prevention of Money-laundering Act, 2002 (PMLA) is to combat money laundering in India in order to prevent and control money laundering, to confiscate and seize the property obtained from laundered money, and to deal with any other issue connected with money laundering in India. It came into force from 1st July, 2015. The Act provides that whosoever directly or indirectly attempts to pamper or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property, shall be guilty of offences of money-laundering. For the purpose of money-laundering, the PMLA identifies certain offences under the Indian Penal Code, the Narcotic Drugs and Psychotropic Substances Act, the Arms Act, the Wild Life (Protection) Act, the Immoral Traffic (Prevention) Act and the Prevention of Corruption Act, the proceeds of which would be covered under this Act.

International initiatives are also taken to fight against drug trafficking, terrorism and other organized and serious crimes have concluded that financial institutions including securities market intermediaries must establish procedures of internal control aimed at preventing and impeding money laundering and terrorist financing. In other nations such as US, The US Congress passed the USA Patriot Act of 2001 within 43 days of Sept.11, October 26, 2001. This Act made as many as 52 amendments to the existing Bank Secrecy Act of 1970 (BSA). The range of these new provisions touched every financial institution and business not only in the US, but also in many countries of the world. One of the changes made in the BSA requires every financial institution to establish anti-money laundering programmes. Moreover, the list of businesses defined as financial institutions is wide ranging and includes banks, brokers and dealers in securities or commodities, currency exchanges, insurance companies, credit card operators, dealers in precious metals, stones and jewels, travel agencies, businesses engaged in the sale of vehicles including automobiles, air planes and boats, casinos and gaming establishments, and even telegraph companies and US postal service. It also adds secretive banking systems, such as 'hawala', to the description of financial institutions. It creates customer documentation and due diligence duties. Simultaneously, it grants immunity to financial institutions and their personnel for sharing reports of doubtful activities with any government agency or with each other. It also makes it a crime to conceal more than US $ 10,000 in money or monetary instruments while entering or leaving the US. Consequently, huge number of financial institutions and businesses, who were not earlier concerned about money laundering, now have to maintain anti-money laundering programmes requiring them to "develop internal policies, procedures and controls", "elect a compliance officer", conduct "ongoing employee training programmes" and perform "independent audit functions".

Currently, the US intelligence agencies can have access to reports and records of financial institutions and businesses including suspicious activity reports filed by them. One of the major changes is ban of correspondent accounts for foreign shell banks, which have no physical presence anywhere. A foreign bank must have a fixed address, employ at least one full-time employee, maintain operating records and be inspected by a banking authority to qualify for a correspondent account. Besides amending the BSA, the USA Patriot Act of 2001 also modified in the Money Laundering Control Act of 1986. It now acquires extra-territorial jurisdiction to combat terrorist funding and criminal proceeds. The law covered funds representing proceeds of nearly 200 specified unlawful activities such as fraud, kidnapping, gambling, espionage, drug trafficking, etc. It now covers bribing of a foreign public official, embezzlement of public funds, smuggling or export control violations involving items covered by the Arms Export Control Act as well as crimes of violence. The new law requires the financial institutions to provide information regarding customers within 120 days if the account is in the US and within seven days if the records are maintained outside the US in respect of correspondence accounts. The new law also supports forfeiture powers over funds of foreign persons and institutions. The US authorities now have vast power to track and grab laundered money that runs terrorist activities and to penalise the criminals involved. The USA Patriot Act of 2001 has also seen a jump in filing SARs. The US Finance Crimes Enforcement Network reported an increase in SARs by over 40 per cent in the year 2002 compared to the preceding year. The compliance costs for the financial institutions have also gone up but many think that this may be a small price to pay to be able to live in a world with reduced risks of terrorist assaults.

Procedures for Anti Money Laundering: Each registered intermediary must implement written procedures to implement the Anti-Money Laundering provisions as envisaged under the Prevention of Money laundering Act, 2002. Such procedures should include inter alia, the following three specific parameters which are related to the overall 'Client Due Diligence Process:

- Policy for acceptance of clients

- Procedure for identifying the clients

- Transaction monitoring and reporting especially Suspicious

In India, to combat the threat of offences of money laundering, the Government is entrusting the work relating to investigation, attachment of property/proceeds of crime relating to the scheduled offences under the Act and filing of complaints etc. to the Directorate of Enforcement, which currently deals with offences under the Foreign Exchange Management Act.

To summarize, money Laundering is spreading at speedy rate at global level and it is a serious matter for legislature authorities that must be curbed for smooth functioning of society and economic enhancement of all nations. All nations have to work together to combat such devastating criminal activity. Money Laundering is fundamentally, the process of transforming, through a series of stages, the proceeds of illegal or criminal activity, into apparently legitimately acquired funds. Today, due to technical modernization, the criminals are very clever and cheat the enforcing agencies through deploying a team of experts like chartered accountants, attorneys, banker's mafia, to cover their illicit money and pretence it as legal income. These professionals charge fee between 10 to 15% of the sum involved. The connection between white-collared criminals, politicians, enforcing agencies and gangs are so strong that it is difficult to break. Bankers also has vital role and without their involvement, the operation cannot be successful. There numerous payment option such wire transfer of funds has further aggravated the difficulties to identify the movement of sludge funds. The international type of money laundering requires international law enforcement cooperation to effectively examine and accuse those that initiate these complex criminal organizations. Money laundering must be combated mainly by penal ways and within the frameworks of international cooperation among judicial and law enforcement authorities. It can be said that simply enactment of Anti-Money Laundering Laws will not resolve such serious crime instead the Law enforcement Community must keep bound with the ever changing dynamics of money Launderers who continually evolves advanced techniques which helps them to implement strict law to curb money laundering.