Utilization of Public Funds

India's total public spending on Centre and States every year on social sectors is less than 7 percent of GDP. During the period of 2005-06, the Union Government's budgetary spending on these sectors has been increased. This steady increase has not translated into any visible increase in overall public spending (in the country) on these sectors as the priority for social sectors in the State Budgets has not increased much over the last decade. When compared with other countries, India's public spending on social sectors as percentage of GDP has been much lower not only than most developed countries but also some of the developing countries for decades now. The financial management of any company must have a sensible financial system supported by effective accounting procedures and internal controls. Properly managed accounting system helps ensure proper control over funds. Accounting policies and procedures are designed to compile accounts fulfilling legal/procedural requirements that govern financial control. Accounts are an essential part of financial management of activities. On the basis of accounts, the Government regulates the shape of its financial and fiscal policies.

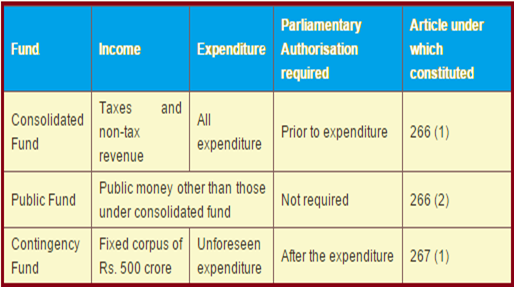

The accounts of Government are retained in three parts:-

- Consolidated Funds of India

- Contingency Funds of India

- Public Account

Consolidated Fund of India

Indian government received all revenues in the form of taxes like Income Tax, Central Excise, Customs and other receipts flowing to the Government in connection with the conduct of Government business i.e. Non-Tax Revenues are credited into the Consolidated Fund constituted under Article 266 (1) of the Constitution of India. Likewise, all loans raised by the Government by issue of Public notifications, treasury bills (internal debt) and loans obtained from foreign governments and international institutions (external debt) are credited into this fund. All expenditure of the government is incurred from this fund and no amount can be withdrawn from the Fund without authorization from the Parliament.

Contingency Fund of India

The Contingency Fund of India records the transactions connected with Contingency Fund set by the Government of India under Article 267 of the Constitution of India. The corpus of this fund is Rs. 50 crores. Advances from the fund are made for the purposes of meeting unforeseen expenditure which are resumed to the Fund to the full extent as soon as Parliament authorizes additional expenditure. Thus, this fund acts more or less like an imprest account of Government of India and is held on behalf of President by the Secretary to the Government of India, Ministry of Finance, Department of Economic Affairs.

Public Account

In the Public Account constituted under Article 266 (2) of the Constitution, the transactions relate to debt other than those included in the Consolidated Fund of India. The transactions under Debt, Deposits and Advances in this part are those in respect of which Government incurs a liability to repay the money received or has a claim to recover the amounts paid. The transactions relating to `Remittance' and `Suspense' shall embrace all adjusting heads. The initial debits or credits to these heads will be cleared eventually by corresponding receipts or payments. The receipts under Public Account do not constitute normal receipts of Government. Parliamentary authorization for payments from the Public Account is therefore not required.

Summary of public funds

Factors that constrain utilization of plan outlays in the social sectors:

Under-utilization of Plan expenditures by the States can be attributed to the institutional and procedural blockages in the process of implementation of Plan schemes and insufficiencies in the planning process being followed at the district level. These factors must be addressed in order to strengthen States' ability to better utilize higher magnitudes of allocations for the social sectors.

- The deficiencies in decentralized planning being carried out in the schemes, resulting due to insufficient staff for undertaking planning activities, inadequate attention to their capacity building and minimal role for community participation in the planning process.

- Blockages in budgetary processes in the schemes, such as delay in the flow of funds, in releasing sanction orders for spending, decision-making in the States being centralized, insufficient delegation of financial powers to the district/ sub-district level authorities and uniform norms of Centrally Sponsored Schemes for all States. Further, lack of need based budgeting in the schemes, which is often carried out without proper analysis of unit costs on the ground, implied allocations for some of the schemes being decided in a top-down and unrealistic manner.

- Systemic feebleness, manifested as shortage of trained, regular staff for various important roles like programme management, finance/accounts and frontline service provision; this contributed to weaken the capacities of the government apparatus in the States for implementation of Plan schemes.

Regarding the systemic weaknesses in the government system in the States, it can be contended that Non-Plan expenditure by the State plays an important role to enhance the overall capacity of the government apparatus. It affects the capacity of the State Government apparatus in terms of the availability of regular qualified staff and adequacy of government infrastructure for implementing Plan schemes. Nevertheless, over the past decade, Non-Plan expenditure in social sectors has been checked by many States due to the emphasis of the prevailing fiscal policy on the reduction of deficits through the restriction of public expenditure. Consequently, the capacity of the government apparatus to implement Plan programmes/schemes has been controlled.