Budget and Budgetary Control

The budget is a vital part of planning and control and it represents as significant mechanism for performance evaluation. The budget is a document designed to assess income and expenditure over a time period usually the previous year and altered to accommodate any predictable variations. In universal terms, a budget is an assessment of the income and expenses over a specified future period of time.

Concept of budget: According to CIMA, London, budget is described as financial and quantitative statement prepared and approved prior to defined period of time, of the policy to be pursued during that period for the purpose of accomplishing a given objective. It may include income, expenditure and employment of capital. In other words, budget refers to a plan covering all the sectors of operations expressed in monetary or quantitative terms for a definite future period (Bhattacharyya, 2011).

A budget can be made for a person, family, and group of people, business, government, country, multinational organization or for any thing that makes and spends money. Budget facilitates people to vigilantly look at how much money they are taking in during a given period, and work out the best way to divide it among various categories. When making a personal budget, an individual will normally assign the appropriate amount of money to fixed expenses such as rent, car payments, or utility bills, and then make an educated estimation for how much money they will spend in other categories, such as groceries, clothing, or entertainment.

Batty explained that the entire process of preparing the budget is known as budgeting. Therefore the term budgeting refers to the act of preparing budget (Bhattacharyya, 2011). In technical view, a budget is a statement that includes a conjecture of revenues and expenditures for a period of time, generally a year. It is a broad plan of action intended to accomplish the policy objectives set by the government for the coming year. A budget is a plan and a budget document is a manifestation of the government actions in future. While any plan need not be a budget, a budget has to be necessarily a plan. It explains detailed and location of resources and pro production and taxation or other method for their understanding. More explicitly, a budget contains information about plans, programmes, projects, schemes and activities-current as well as new proposals for the coming year, resource position and income from different sources, including tax and non-tax revenues, actual receipts and expenditure for the previous year; and economic, statistical and accounting data regarding financial and physical performance of the various agencies and organs of the government.

Many persons, corporations and governments plan their financial actions by preparing budgets. In order to get huge success in business area, an organization must plan its financial activities well in advance. It must assess its income and expenditures using historical data of activities in the past and predict future trends. The budget as explained by numerous experts is not just a financial plan that sets forth cost and revenue goals but it is an effective tool for controlling, synchronization, communication, enthusiasm and performance measurement.

Attributes of budget: A budget must have following features (Bhattacharyya, 2011):

- It should reflect the managerial plans and policies to accomplish business goals and objectives.

- It must be expressed in monetary or quantitative terms or both.

- It is comprehensive plan for definite future period.

- Though it is basically an instrument of planning, it still provides the basis for performance evaluation.

Classification of Budgets

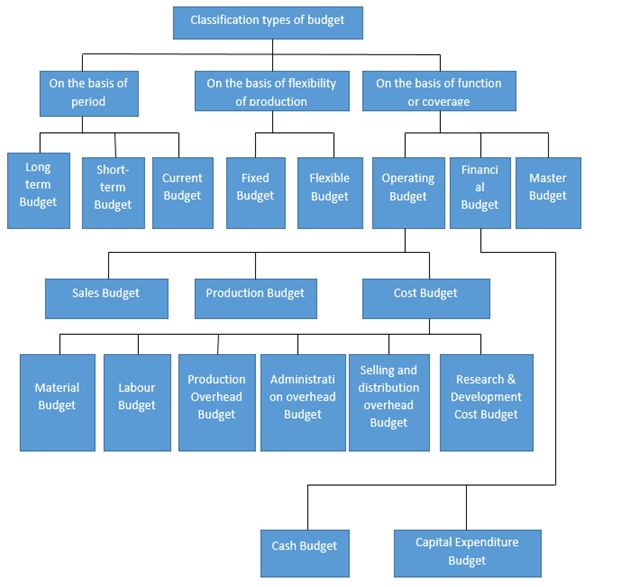

Budget is generally categorized on the basis of the need of respective organization. Preparation of budget may be required by organization for the purpose of its flexibility of production or its functions involved or for the purpose of its period covered.

Classification of budget on the basis of period: On the basis of period, or time covered in budget, it is grouped into short term and long term budget. When budget is prepared for business activity covering a period of more than one year, it is called long term budget. . When budget is prepared for business activity covering a period of one year or less, it is termed as short term budget such as for sales, cash.

Classification of budget on the basis of flexibility of production: In this category, budget is classified into three parts that include fixed, flexible and current budget. Fixed budget is prepared for particular level of production. Flexible budget include series of budgets prepared in respect of different levels of activity during a budget period. Current budget is associated with current business activities of a concern and is prepared under current condition for a very short period.

Classification of budget on the basis of function and coverage: In this heading, budget is grouped into three parts such as operating, financial and master budget. Operating budget is related to different activities of concern. It is a plan of expected revenues and cost. This budget has three categories that include production, cost and sales budget. Financial budgets of function and coverage is associated with all expected financial transactions that are to be incurred during budget period. This is classified into cash and capital expenditure budget. Master budget is the summary of all financial budgets. This budget includes sales budget, production budget, cost budget, cash budget, projected income statement, and projected balance sheet (Bhattacharyya, 2011)

Figure: Classification of budget (Source: Bhattacharyya, 2011):

The Concept of Budgetary Control

Budgetary control is a method to control costs which includes the preparation of budgets. Budgeting is only a part of the budgetary control. Chartered Institute of Management Accountants explained Budgetary Control as "the establishment of the budgets relating to the responsibilities of the executive to meet the objective of an organization and the continuous comparison of actual with budgeted estimates so that if remedial is necessary it may be taken at an early stage". CIMA London elucidated that budgeting control is establishment of budgets relating to the responsibilities of executives of a policy and the continuous comparison of actual with budgeted results either to secure by individual action objective of the policy or to provide a basis for its revision. It can be established that budgeting control is a technique of control under which budgets are prepared at first for all business activities of an organization and actual performance of all those business activities are compared with the respective budgeted data so that corrective measures can be taken for any adverse deviation from the budget (Bhattacharyya, 2011).

Other experts described it as a continuous process which reviews and adjusts budgetary targets during the financial year and produces a control mechanism to hold budget holder to account. This signifies that budgetary control is a system that encompasses the complete process starting from the preparation of the budget or the action plan, covering monitoring and review culminating in counteractive action.

The characteristics of budgetary control are as follows:

- Establish target of performance/budget

- Record the actual performance

- Compare the actual performance with the budgeted

- Establish the differences and analyse the reason

- Act immediately for corrective actions.

Objectives of budgetary control:

Planning: A budget provides a comprehensive plan of action for activities over a definite period of time. Planning helps to anticipate many problems long before they arrive and solutions wanted through careful study.

Next is to coordinate: Budgeting helps managers in coordinating their efforts so that objectives of the organization are synchronized with the objectives of its constituents. This will help in achieving result.

Other objective is to effectively communicate: A budget is a communication tool. The approved budget represents the details of planned activities which assist in communicating the plans. The copies are distributed to the different ministries, extra ministerial departments and agencies.

Another objective is to control: The budget guarantees that plans and objectives are being achieved. Control in budgeting may be combined effort aimed at keeping management informed of what pre-determined plans will achieve. Control comes through variance analysis and reporting.

Objective of budgetary control is to motivate: Careful budgeting control motivates the human resource of the organization.

Performance evaluation: It is most powerful device to management for performance evaluation (Bhattacharyya, 2011).

Advantages of Budgetary Control

There are numerous advantages of budgeting control:

It offers an efficient plan based on facts. It provides definite objectives with regard to future operation.

It acts as standard for evaluation of actual performance.

Control: It facilitates management to control each function, sector, ministry or department in order to accomplish the best possible result.

Coordination: It supports and encourages synchronization between departments of activities for the accomplishment of the overall progress of the organization/institution

Cost awareness: It makes management to become more cost conscious and reduce waste and inefficiency in its operations.

Management by exception: It is a time saving device, as attention is directed to areas of more serious needs.

Management Responsibility: It allows each manager to presume responsibility which is clearly established. It clearly defines the area of responsibility for all concerned executives who are engaged in various business activities.

It increases the operational efficiency of various business actions.

It assists in effective utilization of resources of organization (Bhattacharyya, 2011).

Limitations of Budgetary Control: Besides several benefits, budgetary control has many demerits:

The budget plan is based on estimates: Budgets are based on forecasts and prediction estimates. Absolute exactness is not possible in forecasting and budgeting. The potency or flaw of the budgetary control system depends to a large extent on the precision with which estimates are made.

Danger of rigidity: Budget will not stand the test of time if not flexible because of the dynamic and constant change in business condition.

Management tool: Budget is typically a mechanism of management and cannot reinstate it. Its implementation depends on the will and nature of management concerned. The tool is as good as its applier.

Expensive technique: Budget operation is expensive and need expert team as well as there is incidental expenditure.

Inappropriate condition: Budgets are made round existing organizational structure which may be unsuitable for existing conditions.

In budgets, it is difficult to make clear objectives, fulfil the desired goal.

The process of budgetary control lose its usefulness if it is not revised with changing circumstances (Bhattacharyya, 2011).

Importance of Budgetary Control: In management, there is great significance of budgeting control:

- It increases competence

- It reveals inefficiency positions

- The causes of variances between the budgeted and actual are recognized to chart the remedial process.

- It checks over-expenditure on the part of spending officer.

- It reduces huge losses since it is a constant measuring of actual and budgeted.

Essentials of good budgetary control system:

Good budgetary system must fulfil following requirement (Shah, 2009):

- It should be headed by senior management of organization.

- Representatives of all departments should be made part of the budget committee.

- Organizational goals must be clearly defined.

- There should be proper management information system.

- Periodic reports should be made to disclose the performance of budgeting system.

- Effective follow-up system should be present.

When comparing Budget and Budgetary Control, it can be demonstrated that budget is quantitative plan of action for future period. Whereas Budgetary Control is a system of controlling cost and performances of various business actions through preparation of budgets, assigning responsibilities, evaluation of actual performance by comparing actual results with budgeted data and taking corrective measures in case of any adverse deviation is noticed. Although budget is essential part of Budgetary Control system, both are interrelated and dependent on each other (Bhattacharyya, 2011).

To summarize, Budget and Budgetary Control is the staying power of financial control system. In management literature, budget is plan relating to future. It is statement of various activities to be performed in future and these activities are supported funds. Control exercise for execution of budget is called Budgeting control. Budgeting control represents the application of comprehensive system of budgeting in the organization to help the management in the process of its planning, organizing, coordinating, controlling and performance evaluation. It is an effective device to the management to accomplish the business goals and objectives of the organization.

The stress of financial control was in the private sector. Government organize master budget which is supported by budget classification as revenue, capital expenditure and cash budget. The budget targets are traditionally evolved not by agreement but from top to bottom. The incremental approach to budgeting surpasses the zero-base and programme-cum-performance approaches.