Capital and money markets

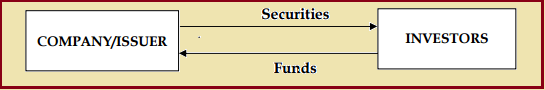

Capital and money markets are the platform where governments and numerous corporations raise money from stakeholders in return for the promise of future revenues.

1. Capital market: Capital market is the market where investment instruments like bonds, equities and mortgages are traded. It is a market which deals in long-term loans. It supplies industry with fixed and working capital and finances medium-term and long-term borrowings of the central, state and local governments. Major function of this market is to make investment from stockholders who have excess funds to the ones who are running a scarcity. The capital market provides both long term and overnight funds.

In financial literature, bulk of economists elaborated the term, capital market. Gold Smith described "the capital market of a modern economy has two basic functions; first the allocation of savings among users and investments; second the facilitation of the transfer of the existing assets, tangible and intangible among individual economic units." According to Grant, Capital market in a broad sense as "a series of channels through which the savings of the community are made available for industrial and commercial enterprises and for public authorities. It embraces not only the system by which the public takes up long term securities directly or through intermediary but also the elaborate network of institutions responsible for short term and medium term lending."

Such explanation indicate that capital market as the market for long term funds. The capital market provides long term debt and equity finance for the government and the corporate sector. The capital market also enables the dispersion of business ownership and reallocation of financial resources among corporate and industries.

Various types of financial instruments that are traded in the capital markets are as under:

- Equity instruments

- Credit market instruments

- Insurance instruments

- Foreign exchange instruments

- Hybrid instruments

- Derivative instruments

There are two types of capital market which include Primary market and Secondary market

Primary Market: Primary Market is that market in which shares, debentures and other securities are sold for the first time to collect long-term capital. This market is concerned with new issues. Therefore, the primary market is also called new issue market. In this market, the flow of funds is from savers to borrowers (industries), therefore, it helps directly in the capital formation of the country. The money collected from this market is normally used by the companies to improve the plant, machinery and buildings, for extending business, and for establishing new business unit.

Features of Primary Market:

- The first characteristic of the primary market is that it is related with the new issues. Whenever a company issues new shares or debentures, it is known as Initial Public Offer.

- Primary market is not the name of any particular place but the activity of bringing in new issues.

- It has several Methods of Floating Capital. Methods of raising capital in the primary market are as follows.

Public Issue: In this technique, the company issues a prospectus and invites the general public to purchase shares or debentures.

Offer for Sale: Under this process, initially the new securities are offered to an intermediary (generally firms of stock brokers) at a fixed price. They further resell the same to the general public. The benefit of this method is that the issuing company feels free from the tedious work of making a public issue.

Private Placement: This process entails that the company sells securities to the institutional investors or brokers instead of selling them to the general public. They, in turn, sell these securities to the selected clients at a higher price. This method is considered as it is a cheaper method to raise funds as compared to a public issue.

Right Issue: This technique is used by companies who have already issued their shares. When an existing company issues new shares, first of all it invites its existing shareholders. This issue is called the right issue. In this case, the shareholder has the right either to accept the offer for himself or assign a part or all of his right in favour of another person.

Electronic Initial Public Issue (e-IPOs): Under this process, companies issue their securities through the electronic medium (i.e. internet). The company issuing securities through this medium enters into a contract with a Stock Exchange. - It Comes before Secondary Market: The transactions are first made in the primary market. The turn of the secondary market comes later.

Benefits of Primary Market:

- Manipulation of price is smaller so investment in primary market is safer.

- No need to time the market the investors get the share at the same price.

- It is secure because of primary research data is collected directly by the organization that deploys the research

- The company receives the money and issues new security certificates to the investors.

Actions in the Primary Market:

- Appointment of merchant bankers

- Pricing of securities being issued

- Communication/ Marketing of the issue

- Information on credit risk

- Making public issues

- Collection of money

- Minimum subscription

- Listing on the stock exchange(s)

- Allotment of securities in demat / physical mode

- Record keeping

Secondary market: The secondary market is that market in which the buying and selling of the formerly issued securities is done. The transactions of the secondary market are usually done through the medium of stock exchange. The main aim of the secondary market is to create liquidity in securities.

Features of Secondary Market:

- It Creates Liquidity

- It Comes After Primary Market

- It Has A Particular Place

- It Boosts New Investments

Benefits of Secondary Market:

- The investors can recover their investments to a certain extent, provided their economic status undergoes a change.

- In such cases the investors may refrain from making long term investments.

- Investor can get large interest by invest for a longer period of time.

Activities in the Secondary Market:

- Trading of securities

- Risk management

- Clearing and settlement of trades

- Delivery of securities and funds

Significance of capital market:

The capital market has significant role in mobilising saving and contribute into productive investments for the development of commerce and industry. The capital market helps in capital formation and economic development of the country.

Economists stated that the capital market acts as a strong link between savers and investors. The savers are lenders of funds while investors are borrowers of funds. The savers who do not spend all their income are called. �Surplus units� and the borrowers are known as �deficit units�. The capital market is the transmission device between surplus units and deficit units. It is a channel through which surplus units lend their surplus funds to deficit units.

Funds flow into the capital market from individuals and financial mediators which are absorbed by business, industry and government. It allows the movement of stream of capital to be used more effectively and profitability to boost the national income.

The capital market provides incentives to savers in the form of interest or dividend and transfers funds to investors. Thus it leads to capital formation. Actually, the capital market provides a market tool for those who have savings and to those who need funds for productive investments. It diverts resources from inefficient and unproductive channels such as gold, jewellery, real estate, conspicuous consumption to productive investments.

An organized and matured capital market comprising expert banking and non-banking intermediaries brings strength in the value of stocks and securities. It does so by providing capital to the needy at reasonable interest rates and helps in reducing speculative activities.

The capital market boosts economic development. The various institutions which operate in the capital market give quantities and qualitative direction to the flow of funds and bring rational allocation of resources. They do so by changing financial assets into productive physical assets. This leads to the development of business and industry through the private and public sector, thereby bringing economic progress.

In an underdeveloped country where capital is limited, the absence of a developed capital market is a greater interference to capital formation and economic development. Even though the people are poor, yet they do not have any inducements to save. Others who save, they invest their savings in wasteful and unproductive channels, such as gold, jewellery, real estate, conspicuous consumption, etc. Such countries can encourage people to save more by establishing banking and non-banking financial institutions for the existence of a developed capital market. Such a market can go a long way in providing a link between savers and investors, thereby leading to capital formation and economic progress.

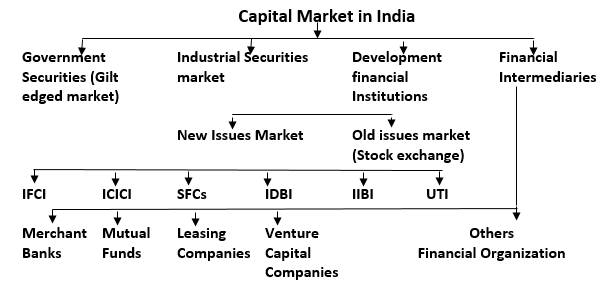

The capital market in India is a market for securities, where companies and governments can increase long term funds. The Indian Equity Market is fully controlled by two major stock exchanges -National Stock Exchange of India Ltd. (NSE) and The Bombay Stock Exchange (BSE). The benchmark indices of the two exchanges - Nifty of NSE and Sensex of BSE are closely monitored by the investors.

In Indian capital market, there are following members which smoothly operate functions of market:

- India Capital Markets Pvt. Ltd.- Members NSE, BSE and NSDL,

- ICM Commodities Pvt Ltd. � Members MCX, NCDEX

- SEBI Registered PMS

The functions of the Indian Capital Market: These are as follows:

- Publicise information efficiently for enabling participants to develop an informed opinion about investment, disinvestments, reinvestment, or holding a particular financial asset.

- Allowing quick valuation of financial instruments-both equity and debt.

- Providing insurance against market risk or price risk through derivative trading and default risk through investment protection fund.

- Empower more participation by enhancing the width of the market by encouraging participation through networking institutions and associating individuals.

- Provide operational efficiency through:

- Simplified transaction procedure.

- Lowering settlement timings.

- Lowering transaction costs.

- Develop integration among:

- Real sector and financial sector.

- Equity and debt instruments.

- Long-term and short-term funds.

- Long-term and short-term interest costs.

- Private sector and government sector.

- Domestic funds and external funds.

- Direct the flow of funds into efficient channels through investment, disinvestments, and reinvestment.

The capital market boosts economic growth by mobilizing the savings of the economic sectors and directing the same towards channels of prolific uses. This is enabled through the following:

- The Industrial Financial Corporation of India (IFC).

- The Industrial Credit and Investment Corporation of India (ICICI).

- The Refinance Corporation of India (RFC).

- The State Financial Development Corporations (SFCs).

- National Industrial Development Corporation (NIDC).

- The State Industrial Development Corporation (SIDCs).

- National Small Industries Corporation (NSIC).

- Industrial Development Bank of India (IDBI).

- Life Insurance Corporation of India (LIC).

- Nationalized Commercial Banks (NCBs).

- Merchant Banking Institutions (MBIs).

- National Industrial Reconstruction Corporation of India (NIRC).

- The Credit Guarantee Corporation of India (CGC).

- Unit Trust of India (UTI)

Above members are mainly financial institutions which offer the liquidity that is required to push the machinery of the Capital Market.

2. Money market:

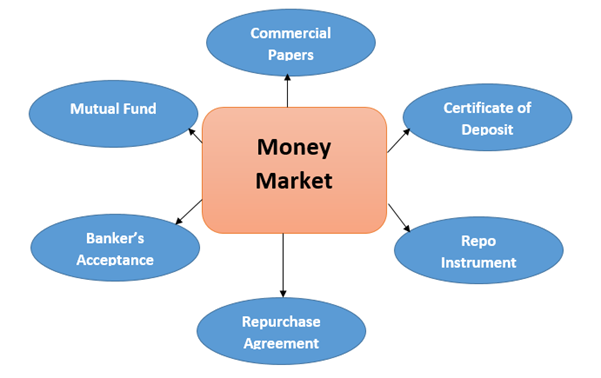

Money market is a tool that manage the lending of short term funds (less than one year). It is a subdivision of the financial market in which financial instrument with high liquidity and very short maturities are traded. There are several money market instruments, including treasury bills, commercial paper, bankers' acceptances, deposits, certificates of deposit, bills of exchange, repurchase agreements, federal funds, and short-lived mortgage-, and asset-backed securities.

Various institutions and economists defined money market in different ways. According to the RBI, "The money market is the centre for dealing mainly of short character, in monetary assets; it meets the short term requirements of borrowers and provides liquidity or cash to the lenders. It is a place where short term surplus investible funds at the disposal of financial and other institutions and individuals are bid by borrowers, again comprising institutions and individuals and also by the government." Nadler and Shipman stated that "A money market is a mechanical device through which short term funds are loaned and borrowed through which a large part of the financial transactions of a particular country or world are degraded. A money market is distinct from but supplementary to the commercial banking system." In money market, transactions of huge amount and high volume take place. It is controlled by few big players. In fact, there are two categories of money market in India that include organized sector and unorganized sector.

Classification of money market

Unorganized sector include chit funds, money lenders and indigenous banks.

Organized sector include commercial banks in India both public sector and private sector and foreign banks

In money market, main players are Government, RBI, DFHI (Discount and finance House of India) Banks, Mutual Funds, Corporate Investors, Provident Funds, PSUs (Public Sector Undertakings), NBFCs (Non-Banking Finance Companies).

Major functions of money market:

- It furnishes to the short-term financial needs of the economy.

- It helps the RBI in effective implementation of monetary policy.

- It provides mechanism to achieve equilibrium between demand and supply of short term funds.

- It helps in allocation of short term funds through inter-bank transactions and money market Instruments.

- It also provides funds in non-inflationary way to the government to meet its deficits.

- It expedites economic growth.

Feature of money market:

- Constituents of Money Market

- Heterogeneous Market

- Dealers of Money Market

- Short-term Loans

- Different from Capital Market

- Association with Big Cities

- Change with Place and Time

Characteristics of A Developed Money Market:

- Existence of Central Bank

- Highly organized commercial Banking System

- Existence of sub-markets

- Integrated structure of money market

- Availability of proper credit instruments

- Adequacy and Elasticity of funds

- International attraction

- Uniformity of interest rates

- Stability of prices

- Highly developed Industrial system

Importance of Money Market:

There is more significance of money market in financing Industry, financing trade, self-sufficiency of banks and effective implementation of monetary policy. Money market encourages economic growth and help to government for proper allocation of resources.

Instrument of Money Market are treasury bills, commercial bills, money at call, promissory notes.

Some new instruments in money market:

Disadvantages of Indian Money Market:

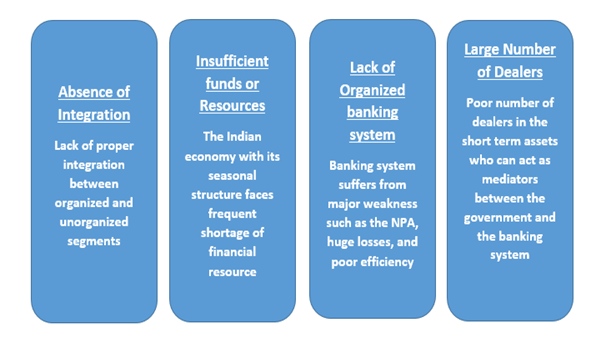

Though the Indian money market is reflected as the progressive money market among developing countries but it still suffers from several drawbacks. These defects limit the productivity of market.

Absence of Integration: The Indian money market is basically divided into the Organized and Unorganized Sectors. The organized sector comprises the legal financial institutions backed by the RBI. The unorganized statement of it includes various institutions such as indigenous bankers, village money lenders, traders. There is lack of proper incorporation between these two segments.

Multiple rate of interest: In the Indian money market, particularly the banks, there are variable rates of interests. These rates vary for lending, borrowing, government activities, etc. Many rates of interests create confusion among the investors.

Inadequate Funds or Resources: The Indian economy with its seasonal structure suffer from frequent shortage of financial recourse. Lower income, lower savings, and lack of banking habits among people are some of the reasons for it.

Shortage of Investment Instruments: In the Indian money market, various investment instruments such as Treasury Bills, Commercial Bills, Certificate of Deposits, Commercial Papers, etc. are used. But taking into account the size of the population and market these instruments are insufficient.

Shortage of Commercial Bill: It is observed that in Indian money market, as many banks keep large funds for liquidity purpose, the use of the commercial bills is very limited. Correspondingly since a large number of transactions are preferred in the cash form, the scope for commercial bills are limited.

Lack of Systematized Banking System: In India, though there is huge network of commercial banks, still the banking system suffers from major flaws such as the NPA, huge losses, and poor efficiency. The absence of the organized banking system is major problem for Indian money market.

Less number of Dealers: There are less dealers in the short-term assets who can act as mediators between the government and the banking system. The less number of dealers leads to the slow contact between the end lender and end borrowers.

Money market is differentiated from capital market on the grounds of the maturity period, credit instruments and the institutions.

- Maturity Period: The money market is involved in the lending and borrowing of short-term finance whereas the capital market deals in the lending and borrowing of long-term finance.

- Credit Instruments: The main credit mechanisms of the money market are call money, collateral loans, acceptances, bills of exchange. In contrast, the main instruments used in the capital market are stocks, shares, debentures, bonds, securities of the government.

- Nature of Credit Instruments: The credit instruments allocated in the capital market are more heterogeneous as compared to money market. Some homogeneity of credit instruments is needed for the operation of financial markets. Too much diversity creates problems for the investors.

- Institutions: Important institutions operating in the money market are central banks, commercial banks, acceptance houses, nonbank financial institutions, and bill brokers. Important institutions of the capital market are stock exchanges, commercial banks and nonbank institutions, such as insurance companies, mortgage banks, and building societies.

To summarize, Capital Market is so beneficial to generate wealth through investment or trade in financial instruments. Here investor can reduce the risk by taking advice or help from any market analyst. Money market signifies inter-bank market where the banks borrow and lend among themselves to meet the short term credit and deposit needs of the economy. The money market is a component of financial market which deals in the borrowing and lending of short term loans generally for a period of less than or equal to 365 days. It is a device to clear short term financial transactions in an economy.