Cost Accounting - Cost Ledger and Control Accounts

Costing is a significant process of determining cost. Kohler described cost accounting as branch of accounting dealing with the classification, recording, allocation, summarization and reporting of current and prospective costs. According to Mr. Wheldon, cost accounting is "the classifying, recording and appropriate allocation of expenditure for the determination of the costs of products or services, the relation of these costs to sales values, and the ascertainment of profitability." Cost accounting has its objective to maintain records associated with internal transactions (Dutta, 2003).

There are numerous aspects of cost accounting:

- Cost classification: This is described as grouping of like items of cost into a common group.

- Cost recording: This denotes to posting of cost transactions into the various ledger maintained under cost accounting system.

- Cost allocation: This refers to allotment of costs to various products or department.

Cost determination or cost finding: This refers to the determination of the cost of goods or services by informal procedure.

Cost reporting: This refers to furnishing of cost data on a regular basis so as to meet the requirements of management.

Under cost accounting system, Cost Ledgers are maintained. Cost ledger is used for maintaining records relating to the real or nominal records. Real accounts are those accounts which contain records of property, possessions or assets of a business enterprise. They relate to cash, building, plant, machinery, furniture or fittings. Nominal accounts deal with income, expense, gain and losses. Thus sales, other income, salaries and wage are example of nominal account (Dutta, 2003). Cost ledger control account serve as a link between financial and cost account.

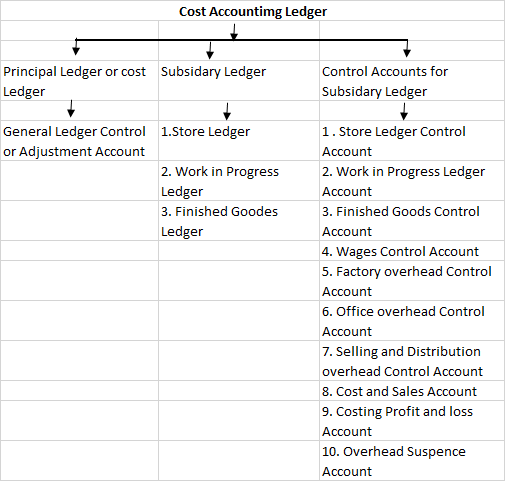

Cost ledger can be categorized into principle ledger and subsidiary ledger with its control account.

Source: Mittal, D K, 2009

Cost ledger is principle ledger of cost account. It contains all impersonal account and similar to general ledger in financial books. The major benefits of cost ledger are that they help in facilitating over material, labour and overhead cost by providing by a summarized record of costs in various ledgers. Cost ledger assures that closing stock of material, work in process and finished products properly valued without any delay. Accounts for each cost centres are prepared separately which serve as basis of cost analysis and control. Necessary data for formulating and setting standard is provided (Macmillan, 2008).

Control Accounts: A control account is a synopsis account in the general ledger. The facts that support the balance in the summary account are enclosed in a subsidiary ledger which is a ledger outside of the general ledger. The intention of the control account is to maintain the general ledger free of details, yet have the correct balance for the financial statements. The details on each client and each transaction would not be recorded in the Accounts Receivable control account in the general ledger. Rather, these details of the accounts receivable activity will be in the Accounts Receivable Subsidiary Ledger. Under interconnecting system, control accounts are maintained in the cost ledger to complete double entry in cost books. These control accounts are total accounts or adjustment accounts summarising accumulation of information contained in the subsidiary ledgers that is stores ledger, job ledger and finished stock ledger.

A control account is maintained in the cost ledger so that double entry in the cost ledger may be completed and make it self-balancing. These control accounts are posted with the totals of items which have been debited or credited in detail to the accounts in the ledgers to which they relate. The balance in control accounts symbolizes the total of balances in a number of accounts of similar nature maintained in that subsidiary ledger to which the control account relates. In addition to these control accounts for each of the subsidiary ledger, a cost ledger control account is also kept in cost ledger. This is operated to make the cost ledger self-balancing.

Advantages: There is several advantage of maintaining cost ledger (Bhabatosh Banerjee, 2014):

- It provides a check to ensure that all expenditure is accounted for in cost accounts with the help of control account.

- It provides a basis for settlement with the financial accounts.

- It provides a ready means of preparing monthly or periodical balance sheet, profit and loss account and statistics relating to cost.

- When cost accounts are separately maintained, it is possible to sustain confidentiality of cost data.

It can be established that cost ledger is principle ledger in cost books which contains a control account for each of the subsidiary ledgers like store ledger control account, work in progress ledger control account, finished goods ledger control account. It also comprises of cost ledger control account/general ledger adjustment account to make the cost ledger self-balancing. A cost ledger control account is maintained in cost ledger to complete the double entry.