Cross-border Mergers and Acquisitions

In globalization period, Cross-border mergers and acquisitions (M&As) have increased radically over the last two decades. Horn and Persson (2001) and Norback and Persson (2004) presented theoretical models where foreign companies may acquire domestic acquisition targets, with the acquisition price being determined endogenously in a bargaining process. In these models, they find that high trade costs do not necessarily induce foreign M&As, contrary to the tariff jumping argument.

Merger: Economic experts explained the concept of Merger the combination of two or more independent business corporations into a single enterprise, usually involving the absorption of one or more firms by a dominant firm. Mergers may be generally classified as Horizontal, Vertical or Conglomerate.

Acquisition: Scholars elucidated this term as an act of one enterprise of acquiring, directly or indirectly of shares, voting rights, assets or control over the management, of another enterprise.

Cross-border mergers and acquisitions (M&As) is in increment trend in contemporary business environment. It is often specified that cross-border capital reallocation is partly the result of financial liberalization policies, government policies and regional agreements. Conventionally, developed countries, and in particular the developed countries of the European Union (EU15) and the United States, have been the major acquirer and target countries of M&As. During 2003-2005 period, developed countries accounted for 85% of the USD 465 billion cross-border M&As, 47% and 23% of which respectively pertains to EU15 and US firms either as acquirer or as target countries (UNCTAD (2006). Cross border Mergers and Acquisitions deals between foreign corporations and domestic firms in the target country. The trend of increasing cross border M&A has become faster with the globalization of the world economy. Definitely, the 1990s were important period for cross border M&A with a nearly 200 percent jump in the volume of such deals in the Asia Pacific region. This region was favoured for cross border M&A as most nations in this region were opening up their economies and liberalizing their policies, which provided the much, needed boost to such deals. It has been observed in current scenario that Latin America and Africa are attracting more cross border M&A. This is due to a combination of political congestion in countries like India that are unable to decide on whether the country needs more foreign investment, the saturation of China, and the rapid emergence of Africa as an investment destination. Additionally, Latin America is being favoured mainly due to the rapid growth rates of the economies of the region.

In spite of increased importance of cross-border M&As, which constitute by far the largest share of foreign direct investment, the determinants underlying such activities remain unclear. Di Giovanni (2005) and Head and Ries (2007) found cultural and geographical proximity to be important determinants of aggregate Mas. Berger at al. (2004) who using Tobit look at determinants of cross-border transaction values in the financial sector; while Goerg et al (2006) and Focarelli and Pozzolo (2008) emphasize the number of cross-border deals using the negative binomial regression model, respectively for M&As in manufacturing sectors and those in banking and insurance.

Motivation for cross-border mergers and acquisitions is to build shareholder value. The drivers of M&A activity are both macro in scope the global competitive environment and micro in scope the variety of industry and firm-level forces and actions driving individual firm value. The main forces of change in the global competitive environment, technological change, regulatory change, and capital market change and create new business opportunities for MNEs, which they pursue aggressively.

Multinational enterprises undertake cross-border mergers and acquisitions for various reasons. The drivers are strategic responses by Multinational enterprises to protect and augment their global competitiveness by

- Gaining access to strategic proprietary assets.

- Gaining market power and dominance.

- Achieving synergies in local/global operations and across industries.

- Becoming larger, and then reaping the benefits of size in competition and negotiation.

- Diversifying and spreading their risks wider.

- Exploiting financial opportunities they may possess and others desire.

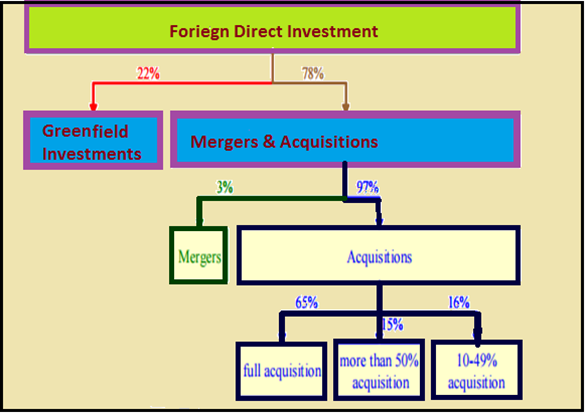

Cross-border M&A is characteristically considered to be a subsection of foreign direct investment ranging from about 50% to 90% depending on the source that is consulted. The remainder of FDI is realised through Greenfield investment. Therefore, a majority of FDI tends to occur through cross-border M&A. While experts think the cross-border M&A as useful component of FDI, the relationship between cross-border M&A and FDI is complicated as is made clear in UNCTAD's World Invest Report for 2000, which is specifically dedicated to the issue of cross-border mergers and acquisitions. FDI, in contrast to cross-border M&A, denotes to transactions between parents and affiliates. Cross-border M&A includes also investments that are financed via domestic and international capital markets. It is not always possible to trace the country from which these funds originate. Moreover, FDI refers to net investments whereas M&A refer to gross transactions (acquisitions and divestments). Due to those differences, it is therefore possible that cross-border M&A exceeds the documented value of FDI.

Distribution of different types of FDI

Basic Characteristics of Cross-border M&As:

Thomson's Global Mergers and Acquisitions database offers the best and extensive data source for M&As to date. Cross border merger and acquisitions are of two types Inward and Outward. Inward cross border M&A's involve an inward capital movement due to the sale of a domestic firm to a foreign investor. Conversely outward cross border M&A's involves outward capital movement due to purchase of a foreign firm. Inward and outward M&A's are closely linked as on a whole M&A transactions comprise of both sales and purchase.

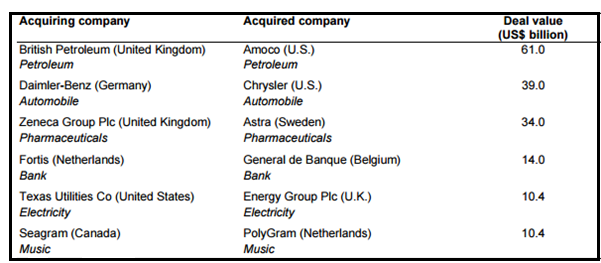

Top companies involved cross-border M&As in 1998 (Source: KPMG Corporate Finance, 1999)

Factors to be considered in Cross Border Mergers and Acquisitions:

It is established in business reports that cross border M&A's actualize only when there are incentives to do so. Both the foreign company and the domestic partner must gain from the deal as otherwise; eventually the deal would turn sour. Many domestic firms in emerging markets overstate their capabilities in order to attract M&A, the foreign firms have to do their due diligence when considering an M&A deal with a domestic firm. Due to these reasons, many foreign firms get assistance of management consultancies and investment banks before they venture into an M&A deal. Apart from this, the foreign firms also consider the risk factors associated with cross border M&A that is a combination of political risk, economic risk, social risk, and general risk associated with black swan events. The foreign firms evaluate potential M&A partners and countries by forming a risk matrix composed of all these elements and depending upon whether the score is appropriate or not, they decide on the M&A deal. Cross border M&A also needs regulatory approvals as well as political support because in the absence of such expediting factors, the deals cannot go through.

Numerous factors which motivate firms for cross border M&A's include

- Globalization of financial markets

- Market pressures and falling demand due to international competition

- Seek new market opportunities since the technology is fast evolving

- Geographical diversification which would result in exploring the assets in other countries

- Increase companies efficiency in producing the goods and services

- Fulfilment of the objective to grow profitably

- Increase the scale of production

- Technology share and innovation which reduces costs

Effects of Cross Border Merger and Acquisitions

Normally, it is apparent that cross border merger and acquisitions are a reformation of industrial assets and production structures on a worldwide basis. It empowers the global transfer of technology, capital, goods and services and integrates for universal networking. Cross border M&A's leads to economies of scale and scope which helps in gaining efficiency. Apart from this, it also benefits the economy such as increased productivity of the host country, increase in economic growth and development particularly if the policies used by the government are favourable.

Capital build-up: Cross border merger and acquisitions support in capital accumulation on a long term basis. In order to expand their businesses it not only undertakes investment in plants, buildings and equipment's but also in the incorporeal assets such as the technical know-how, skills rather than just the physical part of the capital.

Employment creation: It is observed that the M&A's that are undertaken to drive restructuring may lead to downscaling but would lead to employment gains in the long term. The downsizing is sometimes essential for the continued existence of operations. When in the long run the businesses expands and becomes successful, it would create new employment opportunities.

Technology handover: When firms across countries join together, it sustains positive effects of transfer of technology, sharing of best management skills and practices and investment in intangible assets of the host country. This results in innovations and has an influence on the operations of the company.

Cross Border Merger and Acquisitions - Issues and Challenges

It is analysed that cross border merger and acquisitions are quite similar to domestic M&A's. But because the former are huge and international in nature they pose certain unique challenges in terms of different economic, legal and cultural structures. There could be huge differences in terms of customer's choices, business practices, and the culture which could pose as a huge threat for companies to fulfil their strategic objectives. There are many issues and challenges related to cross border merger and acquisitions.

1. Political concerns: Political situation has major role in cross border merger and acquisitions, particularly for industries which are politically sensitive such as defence, security etc. It is also important to concerns of the parties like the governmental agencies (federal, state and local), employees, suppliers and all other interested should be addressed subsequent to the plan of the merger is known to public. In fact in certain cases there could be a requirement of prior notice and discussion with the labour unions and other concerned parties. It is important to identify and evaluate present or probable political consequences to avoid any probability of political risk arising.

2. Cultural challenges: Cultural factors exert more threat to the success of cross border merger and acquisitions. From past records, it can be established that huge mergers that have failed because of the cultural issues they have had. When there are cross border transactions issues arise because of the geographic scope of the deal. Several factors such as differing cultural backgrounds, language necessities and dissimilar business practices have led to fail mergers in spite of being in the age where we can instantly communicate. Research suggests that intercultural disagreement is one of the major indicator of failure in cross-border merger and acquisition. Hence irrespective of what the objective behind the alliance is businesses should be well aware of the of the intercultural endangerment and prospects that come hand in hand with the amalgamation process and prepare their workforce to manage these issues. In order to deal with these challenges businesses need to invest good amount of time and effort to be well aware of the local culture to gel with the employees and other concerned parties. It is better to over communicate and conforming things for successful merger.

3. Legal considerations: Firms interested to merge cannot ignore the challenge of various legal and regulatory issues. Various laws in relation to security, corporate and competition law are bound to diverge from each other. Hence before considering the deal, it is important to review the employment regulations, antitrust statute and other contractual requirements to be dealt with. These laws are very much part of both while the deal is under process and also after the deal has been closed. While undergoing the process of reviewing these concerns, it could indicate that the potential merger or acquisition would be totally incompatible and hence it is recommended to not go ahead with the deal.

4. Tax and accounting considerations: Tax issues are critical particularly when it comes to structuring the transactions. The proportion of debt and equity in the transaction involved would influence the outlay of tax; hence a clear understanding of the same becomes important. Another factor to decide whether to structure an asset or a stock purchase is the issue of transfer taxes. It is very important to lessen the tax risks. Countries also follow different accounting policies though the acceptance of IFRS has reduced this to an extent and many countries have yet to implement it. If the parties in the merger are well aware about the financial and accounting terms in the deal, it would aid in minimizing the misperception.

5. Due diligence: Due diligence is significant element of the M&A process. Apart from the legal, political and regulatory issues, there are also infrastructure, currency and other local risks which need thorough appraisal. Due diligence can affect the terms and conditions under which the M&A transaction would take place, influence the deal structure, and affect the price of the deal. It supports in revealing the danger area and gives a comprehensive view of the proposed dealings. It has been recognized that Cross border merger and acquisition has numerous advantages but also there is high risk of failure. Researches demonstrate that the failure rate is as high as 50% (Valant, 2008). The main reason for that are cultural differences (Badrtalei and Bates, 2007). One of the major merger which has failed is the merger between Daimler and Chrysler.

To summarize, a cross-border M&A is elaborated as an activity in which an enterprise from one country buys the whole asset or controlling percentage of an enterprise in another country. Cross border merger and acquisitions is highly advantageous to companies and also increase its share price but as we saw there are a lot of factors which need to be taken into consideration to avoid any anomalies. It is documented that Cross-border M&A has become one of the leading approaches for firms to gain access to global markets. Though there has been little progress in the research literature to explore the role of culture in the success of these ventures. Poor culture-fit has often been cited as one reason why M&A has not produced the outcomes organizations hoped for (Cartwright & Schoenberg, 2006). Cross-border M&A has the added challenges of having to deal with both national and organizational culture differences. It is imperative for the business structures of both the countries involved in M&A transactions and learn from cases like that of Daimler-Chrysler. Most critical factors which separate the successful M&A transactions from the others, who fail, are thorough and planned preparation and commitment of time and other resources.