Foreign Investment: Foreign direct investment and foreign portfolio investment

1. Foreign direct investment: Foreign Direct Investment, briefly called or FDI, is a form of investment that involves the inoculation of foreign funds into an enterprise that operates in a different country of origin from the financier. Foreign direct investment is vital part of an open and real international economic system and a major promoter to development. Foreign direct investment has developed radically as a major form of international capital transfer since last many years. Between 1980 and 1990, world flows of FDI-defined as cross-border expenditures to acquire or expand corporate control of productive assets-have approximately tripled. Advantages of FDI do not increase automatically and evenly across countries, sectors and local communities. National strategies and the international investment architecture matter for attracting FDI to huge number of developing countries and for reaping the full benefits of FDI for development.

Traditional theories are very advantageous to describe basic long-term patterns of foreign direct investment. For example, they help comprehend the behaviour of U.S. firms during the post-World War I1 period. At that time, progressive U.S. firms were superior in technology and well recognized in overseas markets. U.S. firms tended to move foreign to maintain competitive access to those markets and, in the process, met with comparatively little competition.

Determinates of FDI in Host Country:

Host Country Determinants:

- Policy framework for F.D.I.

- Economic, political & social stability

- Rules regarding entry & operations.

- Standards of treatment of foreign affiliates.

- Policies on functioning & structure of markets (esp. competition & merger and acquisition [M&A] Policies

- International agreements on FDI

- Privatization Policy.

- Trade policy (barriers-tariff & non-tariff) and coherence of FDI and trade policies

Foreign direct investment and growth: Foreign direct investment has great impact on growth by raising total factor productivity and, more generally, the efficacy of resource use in the beneficiary economy. Many empirical studies indicated that FDI contributes to both factor productivity and income growth in host countries, beyond what domestic investment normally would trigger. It is more challenging to assess the scale of this impact, not least because large FDI inflows to developing countries often concur with unusually high growth rates triggered by dissimilar factors. Whether, financial experts asserted, the positive effects of foreign direct investment are lessened by a partial "crowding out" of domestic investment is far from clear. Some investigators have found sign of crowding out, while others determine that foreign direct investment may actually serve to increase domestic investment. Irrespective, even where crowding out does take place, the net effect generally remains beneficial, not least as the replacement tends to result in the release of scarce domestic funds for other investment purposes. In the least developed economies, foreign direct investment seems to have a somewhat smaller effect on growth, which has been attributed to the presence of "threshold externalities".

Seemingly, developing countries need to have reached a certain level of development in education, technology, infrastructure and health before being able to benefit from a foreign presence in their markets. Defective and underdeveloped financial markets may also prevent a country from gaining the full benefits of foreign direct investment. Weak financial intermediation hits domestic enterprises much harder than it does multinational enterprises. In some cases it may lead to a lack of financial resources that precludes them from seizing the business opportunities arising from the foreign presence. Foreign investors' participation in physical infrastructure and in the financial sectors can help on these two grounds.

Foreign direct investment has also contributed in the process of globalization during the past two decades. The speedy expansion in foreign direct investment by multinational enterprises since the mid-eighties may be ascribed to significant changes in technologies, greater liberalization of trade and investment regimes, and deregulation and privatization of markets in many countries including developing countries such as India. Capital formation is an important factor of economic development. While domestic investments add to the capital stock in an economy, foreign direct investment plays a harmonising role in overall capital formation and in filling the gap between domestic savings and investment. At the macro-level, foreign direct investment is a non-debt-creating source of extra external finances. At the micro-level, foreign direct investment enhance productivity, technology, skill levels, employment and linkages with other sectors and regions of the host economy.

Balasubramanyam.V.N and Vidya Mahambre (2003) summarized that foreign direct investment is a very good process to transfer of technology and knowledge to the developing countries. Birendra Kumar and Surya Dev (2003) with the data available in the Indian background presented that the increasing trend in the absolute wage of the worker does not dissuade the increasing flow of foreign direct investment. Laura Alfaro (2003) found that foreign direct investment flows into the different sectors of the economy such as manufacturing, and services exert different effects on economic development. Foreign direct investment inflows into the main sector tend to have a negative effect on growth, whereas foreign direct investment inflows in the manufacturing sector a positive one. It has been observed in many studies that evidence from the foreign investments in the service sector is vague. Sebastin Morris (2004) has debated the factors of foreign direct investment over the regions of huge economy like India. He claims that, for all investments it is the regions of metropolitan cities that attract the bulk of foreign direct investment. Peng Hu (2006) investigated numerous determinants that influence foreign direct investment inflows in India which include economic growth, domestic demand, currency stability, government policy and labour force availability against other countries that are attracting FDI inflows. When analysed the results, it is observed that India has some competitive advantages to attract foreign direct investment inflows, like a large pool of high quality labour force which is an absolute advantage of India against other developing countries like China and Mexico. According to Chandana Chakraborty and Peter Nunnenkamp (2008), successful foreign direct investment in post-reform India is usually believed to promote economic progress. Chew Ging Lee (2009) has designated that GDP per capita has a positive effect on foreign direct investment inflows in the long run.

FDI in India

In Indian context, foreign direct investment is reflected as a developmental tool, which helps to accomplish self-reliance in numerous sectors and in general development of the economy. India after liberalizing and globalizing the economy to the outside world in 1991, there was a enormous increase in the flow of foreign direct investment. In India, foreign direct investment inflow made its entry during the year 1991-92 with the aim to bring together the intended investment and the actual investments of the country. To follow a growth of around 7 percent in the Gross Domestic Product of India, the net capital flows should escalate by at least 28 to 30 percent on the whole. But the savings of the country stood only at 24 percent. The gap formed between intended investment and the actual savings of the country was lifted up by portfolio investments by Foreign Institutional Investors, loans by foreign banks and other places, and foreign direct investments. Among these three forms of financial support, India chooses as well as possesses the maximum amount of Foreign Direct Investments. The FDI may affect due to the government trade obstructions and policies for the foreign investments and leads to less or more effective towards contribution in economy as well as GDP of the economy. To increase the FDI inflows in the country, Indian government allowing frequent equity participation to foreign enterprises apart from provides many incentives such as tax concessions, simplification of licensing procedures and de-reserving various industries like drugs, fertilizers, aluminum. But due to significant outflow of foreign reserve in the form of remittances of dividends, profits, royalties etc in 1973 government of India set up Foreign Investment Board and enacted Foreign Exchange Regulation Act in order to regulate flow of FDI to India. Additionally, Government of India set up Foreign Investment Promotion Board (FIPB) for processing of FDI proposals in India.Benefit of Foreign Direct Investment

Advantages of foreign direct investment for developing country economies are well recognized. Given the appropriate host-country policies and a basic level of development, a majority of studies demonstrations that foreign direct investment generates technology spill overs, helps human capital formation, contributes to international trade integration, helps create a more competitive business environment and enhances enterprise development. All of these contribute to higher economic growth, which is the strongest tool to alleviate poverty in developing countries. Moreover, foreign direct investment may help improve environmental and social conditions in the host country. FDI has other advantages such as foreign expertise can be an important factor in improving the existing technical processes in the country, advances in technology and process it improves the competitiveness of countries in the domestic economy, can improve the quality of products and processes in a particular sector, increased attempts to better human resource. Foreign direct investment can help in the economic development of the country in which the investment is made, creating both benefits for local industry and a more conducive environment for the investor. It will usually create jobs and increase employment in the target country. It will allow resource transfer, and other exchanges of knowledge whereby different countries are given access to new skills and technologies. The equipment and facilities provided by the investor can upsurge the productivity of the workforce in the target country.

The disadvantage of FDI: There are some demerits of foreign direct investment.

- Foreign direct investment can occasionally hamper domestic investment, as it focuses resources elsewhere.

- Sometimes as a result of foreign direct investment exchange rates will be affected, to the advantage of one country and the disadvantage of the other nation.

- Foreign direct investment may be capital-intensive from the investor's point of view, and therefore sometimes high-risk or economically non-viable.

- The rules governing foreign direct investment and exchange rates may negatively affect the investing country.

Classifications of Foreign Direct Investment

Foreign Direct Investment can be categorized as Inward FDI and Outward FDI, depending on the direction of flow of money. Inward Foreign direct investment occurs when foreign capital is invested in local resources. The factors pushing the progression of inward FDI include tax breaks, low interest rates and grants. Outward Foreign direct investment which, also referred to as "direct investment abroad", is funded by the government against all related risk.

Regulatory Framework

Major Indian regulatory authorities in the framework of Foreign Direct Investment are the Foreign Investment and Promotion Board ("FIPB"), which formulates foreign investment policy, and the Reserve Bank of India ("RBI"), India's central bank, with the primary responsibility of implementing and enforcing foreign exchange regulations and government policy.

Major regulations:

- Foreign Exchange Management Act, 1999 (FEMA) and Regulations

- Securities and Exchange Board of India Act, 1992 and Regulations

- Foreign Trade (Development and Regulation) Act, 1992.

- Companies Act, 1956

- Indian Contract Act, 1872

- Arbitration and Conciliation Act, 1996

- Civil Procedure Code, 1908

- Income Tax Act, 1961

- Foreign Direct Investment Policy (FDI Policy)

- Competition Act, 2002

Major governmental authorities:

- Department of Industrial Policy and Promotion (DIPP), Government of India

- Foreign Investment Promotion Board of India (FIPB), Government of India

- Reserve Bank of India (RBI)

- Securities and Exchange Board of India (SEBI)

- Directorate General of Foreign Trade (DGFT), Government of India

- Ministry of Corporate Affairs, Government of India

- Income Tax Department

- Industry specific ministries such as Ministry of Power, Ministry of Communications & Information

- Technology

Issues Regarding FDI in India:

- FDI is permitted through following forms of investments:

- Financial collaborations.

- Joint ventures and technical collaborations.

- Capital markets via Euro issues (Foreign Currency Convertible Bonds (FCCBs)/Equity Shares under the Global Depository Mechanism).

- Private placements or preferential allotments.

Foreign Portfolio Investment

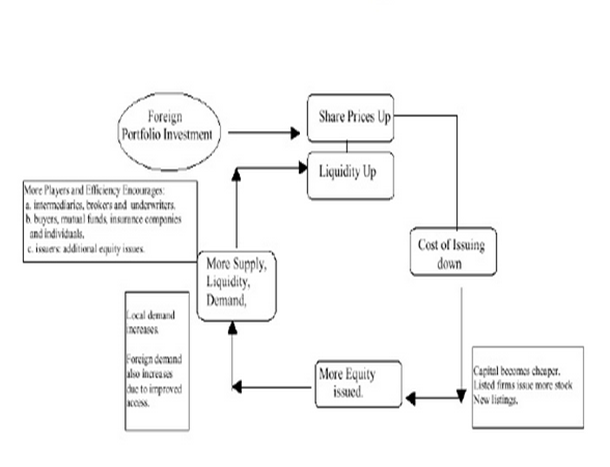

Portfolio investments characteristically encompass transactions in securities that are highly liquid, i.e. they can be bought and sold very fast. A portfolio investment is an investment made by an investor who is not involved in the management of an organization. A foreign portfolio investment is an investment activity that involves the purchase of stocks, bonds, commodities, or money market instruments that are based in a different country. Fundamentally, foreign portfolio investment involves buying of securities, traded in another country, which are highly liquid in nature and, therefore, allow investors to make "quick money" through their frequent buying and selling. Such securities may include instruments like stocks and bonds, and unlike shares, they do not give managerial control to the investor in a company. In some cases, these types of investments are short-term in nature, allowing the investor to quickly take advantage of favourable exchange rates to buy and sell the assets. At other times, the foreign portfolio investment is acquired with plans of holding onto the asset for an extended period of time. The Foreign Exchange Management Act 2000 describes Foreign Portfolio Investment as buying and selling of shares, convertible debentures of Indian companies, and units of domestic mutual funds at any of the Indian stock exchanges. It is the reflexive holding of securities such as foreign stocks, bonds, or other financial assets, none of which entails active management or control of the securities issues by the investor.Analysing historical records, in 1992, India opened up its economy and permitted foreign portfolio investment in its domestic stock market. India is more dependent upon FPI than FDI as a source of foreign investment. During 1992 -2005 more than 50 percent of foreign investment in India came from FPI. Foreign portfolio investment flows have been the most instable component of capital flows in India and has major role in determining the overall balance of payments. During the Asian crisis as well as during the recent sub-prime crisis, it was the huge reversal of FPI flows that led to deterioration in the overall balance of payments. This is because by their very nature FPI flows do not involve a long lasting interest in the economy. The ultimate aim of FPIs is to ensure profits and risk diversification.

After that foreign portfolio investment has developed as a major source of private capital inflow in this country India is more dependent upon FPI than FDI as a source of foreign investment. During 1992 -2005 more than 50 percent of foreign investment in India came from FPI.

FPI flow can help economy:

It can be said that a foreign portfolio investment is no different from purchasing investments that are domestic in nature. Financiers will consider the financial situation of the entity that is issuing the investment, assess the potential for that investment to generate returns over a specific period of time, and consider what type of events could occur that would have a negative impact on the growth potential of that holding. Consideration of the ease of trading the asset when and as desired will also be a factor that investors will assess before selecting to make the purchase.

There are several characteristics of a foreign portfolio investment. Normally, the investor does not desire to be vigorously involved within the management of the asset. Additionally, the investment will not provide the investor with a controlling interest in the issuing company. While the number of shares acquired may be significant, the shares will not position the investor so that he or she has a great deal of control over how the issuer conducts business. Along with the somewhat hands-off nature of a foreign portfolio investment, there may also be certain tax necessities that the investor has to both the nation in which the assets are based and his or her own home country.

Under suitable conditions, a foreign portfolio investment can be effective way to generate a good return in short time. This is managed by paying more attention to current conditions in the foreign exchange market. If the investor can use the right currency to make the purchase, then sell that same investment when exchange rates are in his or her favor, there is the chance to not only earn returns from the upward movement of the investment itself, but also from the current rate of exchange between the two currencies involved.

Factors affecting Portfolio:

- Tax rates on interest or dividends

- Interest rates

- Exchange rates

Benefits of Foreign Portfolio Investment

Foreign portfolio investment augments the liquidity of domestic capital markets, and can help develop market efficiency as well. As markets become more liquid, as they become deeper and array of investments can be financed. New enterprises, for example, have a greater opportunities of receiving start-up financing. Savers have more opportunity to invest with the assurance that they will be able to manage their portfolio, or sell their financial securities quickly if they need access to their savings. In this way, liquid markets can also make longer-term investment more attractive.

Foreign portfolio investment can also bring discipline and knowledge into the domestic capital markets. In broader market, investors will have greater incentives to expend resources in investigating new or emerging investment opportunities. As enterprises compete for financing, they will face demands for better information, both in terms of quantity and quality. This press for fuller disclosure will promote transparency, which can have positive spill-over into other economic sectors.Foreign portfolio investors, without the advantage of an insider's knowledge of the investment opportunities, are especially likely to demand a higher level of information disclosure and accounting standards, and bring with them experience utilizing these standards and a knowledge of how they function.

Foreign portfolio investment assist to promote development of equity markets and the shareholders' voice in corporate governance. As companies compete for finance the market will reward better performance, better prospects for future performance, and better corporate governance. As the market's liquidity and functionality progresses, equity prices will increasingly reflect the fundamental values of the firms, enhancing the more efficient allocation of capital flows. Well-functioning equity markets will also enable takeovers, a point where portfolio and direct investment overlap. Takeovers can turn a poorly functioning firm into an efficient and more profitable firm, strengthening the firm, the financial return to its investors, and the domestic economy.

Foreign portfolio investors also support the domestic capital markets by introducing more sophisticated instruments and technology for managing portfolios. For instance, they may bring with them a facility in using futures, options, swaps and other hedging instruments to manage portfolio risk.

Increased demand for these instruments would be conducive to developing this function in domestic markets, improving risk management opportunities for both foreign and domestic investors. Foreign portfolio investment can help to support domestic capital markets and improve their functioning. This will lead to a better allocation of capital and resources in the domestic economy, and thus a healthier economy. Open capital markets also contribute to international economic development by improving the worldwide allocation of savings and resources. Open markets give foreign investors the opportunity to diversify their portfolios, improving risk management and possibly fostering a higher level of savings and investment.

Policies for Foreign Portfolio Investment

For foreign portfolio investment, robust and controlled financial markets are essential to deal with the intrinsic volatility. The financial system must have the ability to assess and manage risks if it is to prudently and productively invest capital flows, foreign or domestic. Its major role of financial intermediation and credit allocation is a key element of financial development. Foreign portfolio investment can be an important participant in this function, and bring added strengths and benefits, but those benefits will be most effective when working within a healthy financial system.

For smooth financial system, the institutions within it must be able to recognise, monitor and manage business risks competently. The payments system, through financial institutions and clearing houses, must be efficient and reliable. The financial system must also have the capability to resist economic shocks, such as a substantial change in the exchange or interest rates, or a sudden capital withdrawal. It must be able to tolerate systemic shocks, such as financial distress or bank failure. Systemic risk, from economic or systemic shocks, is a central, and perhaps unique, element of capital markets. It demands adequate capitalization and risk management capabilities. Satisfactory and sound practical supervision is necessary for developing healthy financial system. Financial institutions face a myriad of risks: from credit risk to exchange rate risk, from liquidity risk to exposure concentration risk, from various risks stemming from the institution's internal operations to risks inherent in the payments system. Supervisors need to have a sound understanding of all these types of risk and how they can be managed. They also need to understand the environment in which the banks operate, and the various ways these risks can be transmitted. Adequate capital is a necessary element of prudential regulation, providing a safeguard against losses and a cushion in the face of institutional or systemic problems. Financial institutions should also limit their exposure to individual or associated counterparties, to related parties, to market risk, to short-term debt or mismatches in liquidity. The IMF and World Bank have developed effective banking supervision frameworks through financial sector surveillance and assessment, carried out, at least in part, through the Financial Sector Assessment Programme and through Reports on Observance of Standards and Codes.

Although supervisors need to be able to authenticate that a financial institution's exposure is balanced and capital is adequate, the extent of specificity in the regulations should be a function of the overall soundness and structure of the financial system. Regulation and regulators will be most effective when they create incentives for sound behavior and when their application and practices are able to evolve with the needs of the market. Supervisors need to be aware of the risks and costs of excessive prudential regulation. The costs will be seen in the time and resources required to comply with the regulations, which should be balanced against the need for regulation, but they will also be seen in the effect on innovation and evolution in the markets, which can bring benefits to both the financial markets and the broader domestic economy.

Excessive regulation and supervision can put the responsibility for effective management of financial institutions on the supervisory authorities, rather than the directors and managers of the institutions. This will reduce the effectiveness of management and of market disciplines, potentially the most practical and efficient "regulators." The right balance is essential. Market discipline can provide the greatest incentives for effective risk management. Therefore, it is important not to undermine it by excessive regulation, but there are other factors to watch to ensure that market discipline is effective. Market discipline depends on clear signals from the market. Government guarantees of financial institutions, or implicit government support, can keep the market from signaling a growing problem, as can government ownership. Financial safety nets and market failure response arrangements need to be able to effectively resolve market distress situations, without creating unnecessary moral hazard. If financial safety nets and market failure responses are not appropriately designed, they can take away, or at least reduce, the financial institution's incentive to manage its risks adequately, the first and best line of defense against risks. Competition in the financial sector will also support market disciplines, and a financial sector open to foreign investment, which can bring with it new and different outlooks and approaches to these problems, will help accomplish the benefits of competition.

It is established in reports that FPI can bring about speedy development, assisting an emerging economy move quickly to take advantage of economic opportunity, creating many numerous jobs and significant wealth. However, when a country's economic situation takes a downturn sometimes just by failing to meet the expectations of international investors the large flow of money into a country can turn into a stampede away from it. In contrast, foreign direct investment is more difficult to pull out or sell off. Subsequently, direct investors may be more committed to managing their international investments, and less likely to pull out at the first sign of trouble. Both kind of investments are needed for a developing country. But FPIs are characteristically volatile, as they can be reversed easily. But FDI cannot be reversed easily. To summarize, foreign direct investment (FDI) as a strategic constituent of investment is required by India to accomplish the economic improvements and maintains the speed of growth and development of the economy. Foreign Portfolio Investment (FPI) mainly interacts with the real economy through the stock market, they are often believed as unstable money, which are triggered by short term considerations of the foreign investors and these inflows are deemed to be volatile and tend to be withdrawn during the liquidity crisis (Goldstein and Razin 2002). The financial risk that was assessed by the foreign investors was found to be higher. Investors felt that the governments of developing countries were more likely to default on their debt because of the deteriorating economic situation. Both foreign direct and portfolio investment bring several benefits for economic growth, though there may be a marked difference between those benefits.