Index Numbers

Index numbers are intended to measure the degree of economic changes over time. These numbers are values stated as a percentage of a single base figure. Index numbers are important in economic statistics. In simple terms, an index (or index number) is a number displaying the level of a variable relative to its level (set equal to 100) in a given base period.

Index numbers are intended to study the change in the effects of such factors which cannot be measured directly. Bowley stated that "Index numbers are used to gauge the changes in some quantity which we cannot observe directly". It can be explained through example in which changes in business activity in a nation are not capable of direct measurement but it is possible to study relative changes in business activity by studying the variations in the values of some such factors which affect business activity, and which are proficient of direct measurement.

Index numbers are usually applied in statistical device to measure the combined fluctuations in a group related variables. If statistician or researcher wants to compare the price level of consumer items today with that predominant ten years ago, they are not interested in comparing the prices of only one item, but in comparing some sort of average price levels (Srivastava, 1989). With the support of index numbers, the average price of several articles in one year may be compared with the average price of the same quantity of the same articles in a number of different years. There are several sources of 'official' statistics that contain index numbers for quantities such as food prices, clothing prices, housing, and wages.

Index numbers may be categorized in terms of the variables that they are planned to measure. In business, different groups of variables in the measurement of which index number techniques are normally used are price, quantity, value, and business activity.

Types of Index Numbers

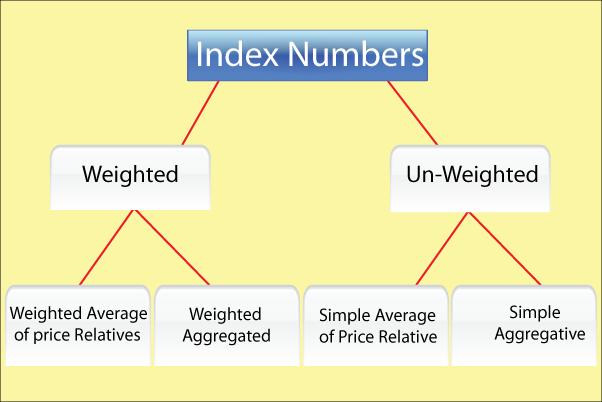

Simple Index Number: A simple index number is a number that measures a relative change in a single variable with respect to a base. These type of Index numbers are constructed from a single item only.Composite Index Number: A composite index number is a number that measures an average relative changes in a group of relative variables with respect to a base. A composite index number is built from changes in a number of different items.

Price index Numbers: Price index numbers measure the relative changes in prices of a commodity between two periods. Prices can be either retail or wholesale. Price index number are useful to comprehend and interpret varying economic and business conditions over time.

Quantity Index Numbers: These types of index numbers are considered to measure changes in the physical quantity of goods produced, consumed or sold of an item or a group of items.

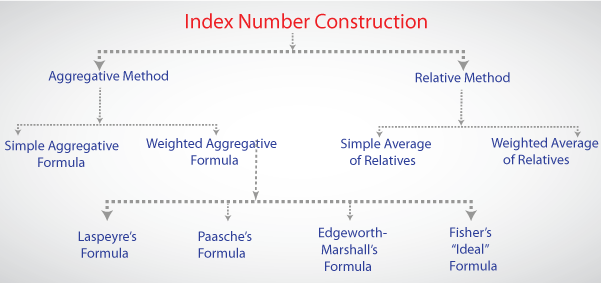

Methods of constructing index numbers: There are two methods to construct index numbers: Price relative and aggregate methods (Srivastava, 1989).

In aggregate methods, the aggregate price of all items in a given year is expressed as a percentage of same in the base year, giving the index number.

|

|

Aggregate price in the given year |

|

|

Index Numbers |

= |

|

X |

100 |

|

|

Aggregate price in the base year |

|

|

Relative method: The price of each item in the current year is expressed as a percentage of price in base year. This is called price relative and expressed as following formula:

|

|

Price in the given year |

|

|

Price Relative |

= |

|

X |

100 |

|

|

Price in the base year |

|

|

|

Pn |

|

|

|

|

X |

100 |

|

P0 |

|

|

In simple average of relative method, the current year price is expressed as a price relative of the base year price. These price relatives are then averaged to get the index number. The average used could be arithmetic mean, geometric mean or even median.

Weighted index numbers: These are those index numbers in which rational weights are assigned to various chains in an explicit fashion.

Weighted aggregative index numbers: These index numbers are the simple aggregative type with the fundamental difference that weights are assigned to the various items included in the index.

Characteristics of index numbers:

- Index numbers are specialised averages.

- Index numbers measure the change in the level of a phenomenon.

- Index numbers measure the effect of changes over a period of time.

Uses of Index number: Index numbers has practical significance in measuring changes in the cost of living, production trends, trade, and income variations. Index numbers are used to measure changes in the value of money. A study of the rise or fall in the value of money is essential for determining the direction of production and employment to facilitate future payments and to know changes in the real income of different groups of people at different places and times (Srivastava, 1989). Crowther designated, "By using the technical device of an index number, it is thus possible to measure changes in different aspects of the value of money, each particular aspect being relevant to a different purpose." Basically, index numbers are applied to frame appropriate policies. They reveal trends and tendencies and Index numbers are beneficial in deflating.

Problems associated with index numbers (Srivastava, 1989):

- Choice of the base period.

- Choice of an average.

- Choice of index.

- Selection of commodities.

- Data collection.

To summarize, an index number measures the relative variation in price, quantity, value, or some other item of interest from one time period to another. Index numbers are used to measures all types of quantitative changes in the agricultural, industrial, and commercial fields, as also in such economic magnitudes as income, employment, exports, imports, and prices. Thorough investigation of these changes assists the government to implement appropriate financial measures in order to accomplish growth with firmness. Index numbers are termed as a measure of change, a device to measure change or a series representing the process of change. Index numbers are used as an indicator to indicate the changes in economic activity. They also provide framework for decision making and to predict future events. There are three types of index numbers which are generally used. They are price index, quantity index and value index. These index numbers can be developed either by aggregate method or by average of relative method.