Standard Costing and Variance Analysis

In fast growing business world, major goal of organizations is to reduce the cost of production and control the cost as there are limited resources in business and manufacturing concern. Cost accounting has numerous significant tools in order to attain these goals such as standard costing.

Standard Costing

Standard costs are extensively recognized in all countries of world. It is an effectual procedure to control cost and assist to accomplish organizational goal. Standard costs are realistic estimates of cost based on analyses of both past and projected operating costs and conditions. In this procedure, standard cost of the product and services is determined in advance and comparing it with actual cost variance to ascertain and analyse. Huge accounting literature has stated that standard costing is the preparation and use of standard costs, their comparison with actual cost and the analysis of variance to their causes and points of incidence (ICMA, London). According Wheldon, standard costing is the method of ascertaining the costs whereby statistics are prepared to show standard cost, actual cost, and the difference between these costs which is termed as variance. Other theorists like Brown and Howard described that standard costing is a technique of accounting which compares the standard cost of product and services with actual cost to determine the efficiency of operations so that remedial actions can be taken immediately (Gupta, et, al., 2006).

The three components of standard costing:

- Standard costs, which provide a standard, or predetermined performance level.

- A measure of actual performance.

- A measure of the variance between standard and actual performance.

Standard costing uses estimated costs completely to calculate all three elements of product costs: direct materials, direct labour, and overhead. Managers use standard costs for planning and control in the management process such as planning for budget development; product costing, pricing, and distribution.

The main difference between standard costing in a service organization and standard costing in a manufacturing organization is that a service organization has no direct materials costs. In a standard costing system, costs are entered into the Materials, Work in Process, and Finished Goods Inventory accounts and the Cost of Goods Sold account at standard cost; actual costs are recorded separately.

The following elements are used to verify a standard cost per unit:

- Direct materials price standard

- Direct materials quantity standard

- Direct labour rate standard

- Direct labour time standard

- Standard variable overhead rate

- Standard fixed overhead rate

Determination of Standard Costs

The following initial steps must be taken before determination of standard cost:

- Establishment of Cost Centres: It is the primary step required before setting of Standards.

- Classification and Codification of Accounts: Categorization of Accounts and Codification of different items of expenses and incomes assist quick ascertainment and analysis of cost information.

- Types of Standards to be applied: Determination of the type of standard to be used is vital steps before establishing of standard cost. There are numerous standards:

- Ideal Standard

- Basic Standard

- Current Standard

- Expected Standard

- Normal Standard

- Organization for Standard Costing: The achievement of the standard costing system depends upon the consistency of standards, therefore the responsibility for setting standard is vested with the Standard Committee. It consists of following team:

- Purchase Manager

- Production Manager

- Personnel Manager

- Time and Motion Study Engineers

- Marketing Manager and Cost Accountant

- Setting of Standards: The Standard Committee is responsible for developing standards for each component of costs such as Direct Material, Direct Labour, Overheads ( Fixed overheads and Variable Overheads).

Features of Standard Costing

Standard costing is a technique of cost accounting.

The cost or service or product is predetermined.

The predetermined cost is known as standard cost.

Actual cost of product and service is ascertained.

The comparison is made between standard cost and actual cost and variances are noted.

Variances are analysed to find out the reason.

Variances are reported to management in order to take corrective action.

Ways of Developing Standards

The direct materials price standard is based on a vigilant estimate of all possible price increases, changes in available quantities, and new sources of supply in the next accounting period.

The direct materials quantity standard is based on product engineering specifications, the quality of direct materials, the age and productivity of machines, and the quality and experience of the work force.

The direct labour rate standard is defined by labour union contracts and company personnel policies.

The direct labour time standard is based on current time and motion studies of workers and machines and records of their past performance.

The standard variable overhead rate and standard fixed overhead rate are found by dividing total budgeted variable and fixed overhead costs by an appropriate application base.

Merits of standard costing: It is a very useful tool to control the cost. It is the analysis of variances which reduces the cost and increase profitability. It is also beneficial for management because it assists in fixation of selling price, ascertaining the value of closing stocks of work in progress, determining idle capacity, and performs various management functions. The standards provide incentives and motivation to work and help in increasing efficiency and productivity. This technique is helpful in optimal use of resources. Standard costing helps in budgetary control and in decision making. This technique is economical for users (Gupta, et, al., 2006).

Demerits of Standard costing: In this technique, establishing standards is difficult. Standards are determined by keeping in view the marketing condition, availability, and efficiency of labour, machine and plant. All these factors are not static. Standard costing requires specialists and expert staff. This involves heavy expenditure for the concern. This technique is impractical for small scale industries (Gupta, et, al., 2006).

It can be established that Standard Costing is a notion of accounting to determine of standard for each constituent of costs. These fixed costs are compared with actual costs to realize the deviations known as "Variances". Recognition and analysis of causes for such variances and corrective measures should be taken in order to beat the reasons for Variances.

Variance Analysis

Variance analysis is the procedure of computing the differences between standard costs and actual costs and recognizing the causes of those differences. Studies indicated that variance is the difference between standard performance and actual performance. It is the process of scrutinizing variance by subdividing the total variance in such a way that management can assign responsibility for off-Standard Performance.

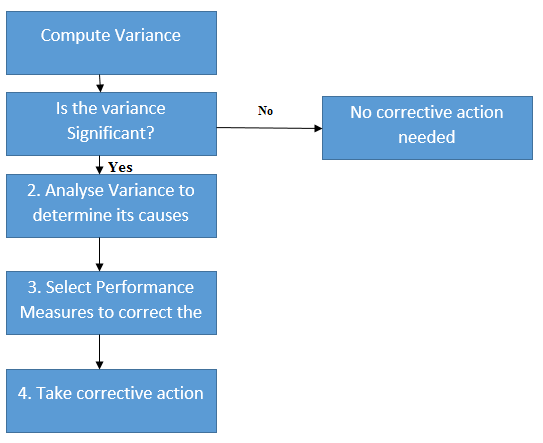

Variance analysis has four steps:

- Compute the amount of the variance.

- Determine the cause of any significant variance.

- Identify performance measures that will track those activities, analyse the results of the tracking, and determine what is needed to correct the problem.

- Take corrective action.

The variance can be favourable variance or unfavourable variance. When the actual performance is superior to the Standard, it resents "Favourable Variance." Likewise, where actual performance is under the standard it is called as "Unfavourable Variance."

Variance analysis assists to fix the responsibility so that management can determine-

- The amount of the variance

- The reasons for the difference between the actual performance and budgeted performance.

- The person responsible for poor performance

- Corrective actions to be taken.

Types of Variances: Variances is categorized into two categories that include Cost Variance and Sales Variance.

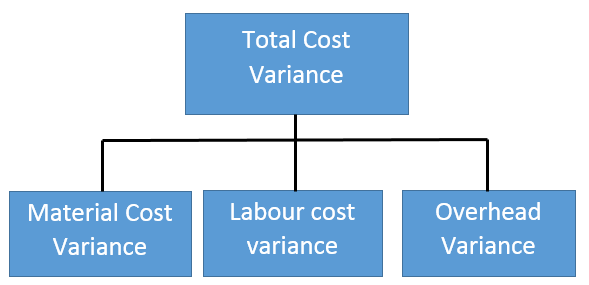

Cost Variance: Total Cost Variance is the difference between Standards Cost for the Actual Output and the Actual Total Cost sustained for manufacturing actual output. The Total Cost Variance consists of:

- Direct Material Cost Variance

- Direct Labour Cost Variance

- Overhead Cost Variance

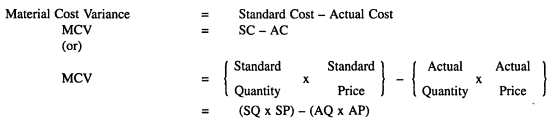

Direct Material Variances: Direct Material Variances are also known as Material Cost Variances. The Material Cost Variance is the difference between the Standard cost of materials for the Actual Output and the Actual Cost of materials used for producing actual output. The Material Cost Variance is computed as:

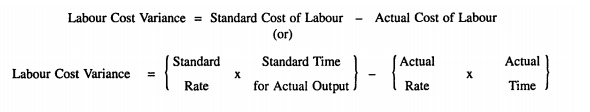

Labour Cost Variance: Labour Cost Variance is the difference between the Standard Cost of labour allowed for the actual output achieved and the actual wages paid. It is also termed as Direct Wage Variance or Wage Variance. Labour Cost Variance is calculated as follow:

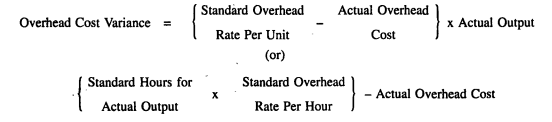

Overhead variance: Overhead is explained as the cumulative of indirect material cost, indirect labour cost and indirect expenses. Overhead Variances may occur due to the difference between standard cost of overhead for actual production and the actual overhead cost incurred. The Overhead Cost Variance may be computed as follows:

Component of Variance analysis.

Component of Variance analysis.

Sales variance: The Variances so far analysis is linked to the cost of goods sold. Quantum of profit is derived from the difference between the cost and sales revenue. Cost Variances affect the amount of profit positively or unfavourably depending upon the cost from materials, labour and overheads. Additionally, it is important to analyse the difference between actual sales and the targeted sales because this difference will have a direct impact on the profit and sales. Therefore the analysis of sales variances is important to study profit variances.

Sales Variances can be calculated by two methods:

- Sales Value Method.

- Sales Margin or Profit Method.

Basis of Calculation: Variance analysis emphasizes the causes of the variation in income and expenses during a period compared to the financial plan. In order to make variances significant, the idea of 'flexed budget' is used when calculating variances. Flexed budget acts as a link between the original budget (fixed budget) and the actual results. Flexed budget is prepared in retrospect based on the actual output. Sales volume variance accounts for the difference between budgeted profit and the profit under a flexed budget. All remaining variances are calculated as the difference between actual results and the flexed budget.

To summarize, Variance Analysis, is administrative accounting which denotes to the analysis of deviations in financial performance from the standards definite in organizational budgets. In Variance Analysis, the difference between actual cost and its budgeted or standard cost segregated into price or quality component. It has been shown that favourable variance occurs when output exceeds input or when the price paid for the goods and services is less than anticipated. An unfavourable variance occurs when output is less than input or when the price for goods and services is greater than expected.