Strategic Alliance

Strategic alliance in management arena is a treaty between two or more companies to collaborate in a particular business activity, so that each benefits from the strengths of the other, and gains competitive advantage (Mockler, 1999). The development of strategic alliances has been envisaged as a response to globalization and increasing vagueness and intricacy in the business environment. Strategic alliances encompasses the sharing of knowledge and expertise between associates as well as the lessening of risk and costs in areas such as relationships with suppliers and the development of new products and technologies. Strategic alliance is sometimes equated with a joint venture, but an alliance may involve competitors, and generally has a shorter life span. Strategic alliances developed and spread as formalized interorganizational relationships, mainly among companies in international business systems. These supportive arrangements seek to accomplish organizational objectives better through partnership than through competition, but alliances also create problems at several levels of analysis.

Theoretical Framework

Strategic alliance can be defined as a process where contributors willingly adapt their basic business practices with a purpose to decrease repetition and waste while facilitating better performance (Frankel, Whipple and Frayer, 1996). A strategic alliance has to contribute to the positive implementation of the strategic plan, therefore, the alliance must be strategic in nature. The relationship has to be supported by executive leadership and formed by lower management at the highest, macro level. Simply, a strategic alliance is referred to as "partnership" that offers businesses a chance to join forces for a mutually beneficial opportunity and sustained competitive advantage (Yi Wei, 2007).Buttery et.al.(1994) described strategic alliances as "two or more organizations involved in mutually advantageous relationships that maintain all participants as separate corporate entities" (1994). Cauley De La Sierra (1995) debates an international viewpoint of alliances and the differences between alliances and traditional joint ventures and uses the term "competitive alliance" to offer the view that alliances are ventures between strong international companies that generally remain competitors outside the relationship. Another group of theorists, Wheelan and Hunger (2000) explained strategic alliance as "an agreement between firms to do business together in a way that go beyond normal company to company dealings but fall shorts of a merger or a full partnership".

There are many reason for strategic alliances (Srinivasan, 2014):

- Increased manufacturing and technological capabilities.

- Provide access to specific market.

- Reduce financial risk.

- Reduce political risk

- Ensure competitive advantage

- Organic growth alone is insufficient for meeting most organizations' required rate of growth.

- Speed to market is essential, and partnerships greatly improve it.

- Complexity is increasing, and no single organization has the required total expertise to best serve the customer.

- Partnerships can defray rising research and development costs.

- Alliances facilitate access to global markets.

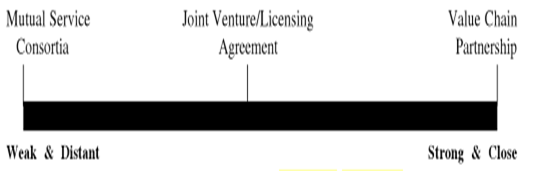

Strategic alliances can be in the form of mutual services, consortia which essentially means partnership of similar companies and similar industries to gain benefits that too expensive to develop alone. When companies cannot legally merge, they combine the strength of the partners to gain outcome which is of value of both allies (Srinivasan, 2014).

Licensing agreement refers to an agreement in which licensing firm grants rights to another firm in another country or market to produce or sell product. The value chain partnership is strong and close alliance in which one company or alliance forms a long term arrangements with important suppliers or distributers for mutual benefits (Srinivasan, 2014).

Historically, strategic alliance in defined by numerous management theorists. In the decade of 70's, entrepreneurs were more concerned about the performance of the product. Alliances aimed to obtain the best raw materials, the lowest prices, advanced technology and improved market penetration globally.

In the decades of 80's, the main objective of companies became merging of the company's position in the sector, using alliances to shape economies of scale and scope. In this period, there was an outburst of alliances. For example, the one between Boeing and a consortium of Japanese companies to build the fuselage of the passenger transport version of the 767; the alliance between Eastman Kodak and Canon, which allowed Canon to produce a line of photocopiers sold under the Kodak brand; an agreement between Toshiba and Motorola to combine their respective technologies in order to produce microprocessors.

Harbison and Pekar (1998) stated that during 90's, collapsing barriers between many geographical markets and the distorting of borders between sectors brought the expansion of capabilities and competencies to the centre of attention. It became necessary to forestall one's competitors through a continuous flow of innovations giving recurrent competitive advantage.

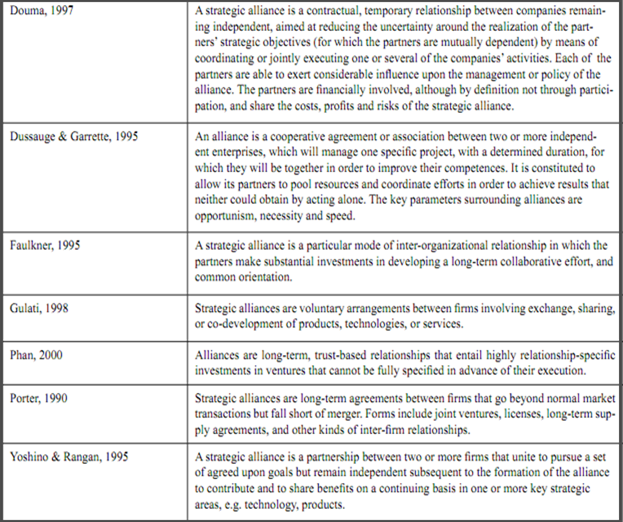

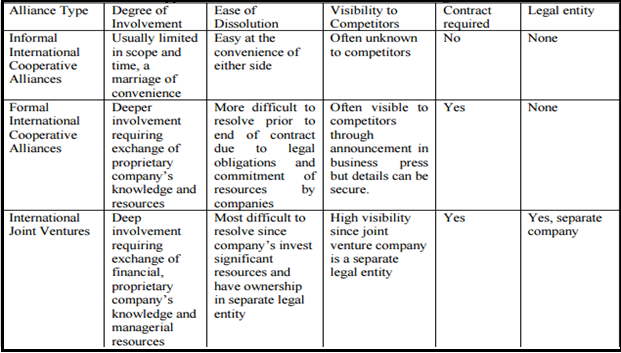

Different theoretical view of strategic alliances (Source: Yi Wei, 2007)

There are numerous theories developed on strategic alliance that concentrate on the reasons why firms enter into closer business relationships. These theories include transaction costs analysis (Williamson,1975,1985),competitive strategy(Porter,1980),resource dependence (Pfeffer and Salancik,1978;Thompson,1967), political economy(Benson,1975;Stern and Reve,1980),social exchange theory (Anderson and Narus,1984).

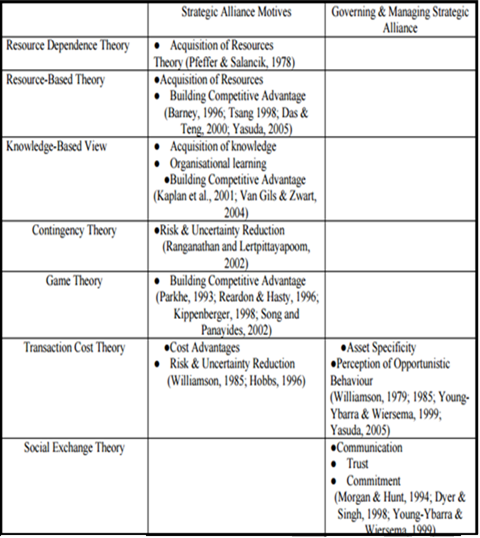

Summary of different theories of strategic alliances (Source: Siew-Phaik Loke et.al, 2009)

There are three major types of international strategic alliances (Lorange and Roos, 1992)

Managing Strategic Alliance

Strategic alliance is an intricate corporate strategy that is difficult to manage (Kazmi, 2008). Walters, et. al., proposed four principles to manage strategic alliances:- Clearly define strategy and assign responsibility.

- Phase in the relationship between partners.

- Blend the cultures of partners.

- Provide for an exit strategy.

A strategic alliance facilitate to successfully implement strategic plan; therefore, the alliance must be strategic in nature. The relationship has to be continued by executive leadership and formed by lower management at the highest, macro level. Consequently, a strategic alliance has to be demarcated as a relationship between organizations for the purposes of attaining successful implementation of a strategic plan. In order to achieve efficiency, speed and quality in different products in more complex environment, firms have had to slender their concentration on core competencies and to turn to outside sources to get complementary resources, technical competences and knowledge (Plake and Somers, 1998).

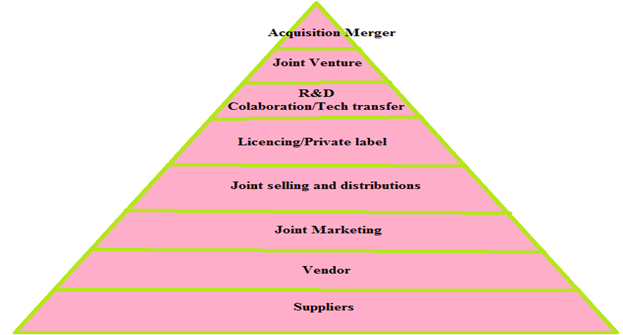

Categories of Strategic Alliances

There are many forms of strategic alliances which are mentioned below:Joint Ventures: A joint venture is a contract by two or more companies to form a single entity to do a certain project. Each of the businesses has a fairness stake in the individual business and share revenues, expenses and profits. Joint ventures between small firms are very infrequent, because of the required commitment and costs involved.

Outsourcing: Outsourcing was emerged in the decade of 80s and this trend continued throughout the 1990s to today, although to a slightly lesser extent. Affiliate Marketing: Affiliate Marketing has detonated recently, with the most successful online retailers using it to great effect. The nature of the internet means that referrals can be precisely tracked right through the order process.

Technology Licensing: This is a contractual arrangement whereby trademarks, intellectual property and trade secrets are licensed to an external firm. It is used primarily as a low cost way to enter foreign markets. The main disadvantage of licensing is the loss of control over the technology as soon as it enters other hands there is the possibility of misuse.

Product Licensing: This is analogous to technology licensing except that the license provided is only to manufacture and sell a certain product. Usually each licensee will be given an exclusive geographic area to which they can sell to. It is a lower-risk way of expanding the reach of company product compared to building manufacturing base and distribution reach.

Franchising: Franchising is an outstanding way of getting success countrywide. Franchisees pay a set-up fee and agree to ongoing payments so the process is financially risk-free for the company. However, disadvantages of this alliance is particularly with the loss of control over how franchisees run their franchise.

R&D: Strategic alliances based around R&D tend to fall into the joint venture category, where two or more businesses decide to embark on a research venture through forming a new entity.

strategic alliance

Stages of strategic alliance formation

Traditional strategic alliance formation process involves these steps:- Strategy Development: Strategy development involves reviewing the alliance's practicability, objectives and rationale, focusing on the major issues and challenges and development of resource strategies for production, technology, and people. It necessitates aligning alliance objectives with the overall corporate strategy.

- Partner Assessment: Partner valuation involves analysing a potential partner's strengths and mistakes, creating strategies for accommodating all partners' management styles, preparing proper partner selection principles, understanding a partner's motives for joining the alliance and addressing resource capability gaps that may exist for a partner.

- Contract Negotiation: Contract negotiations encompasses determining whether all parties have realistic objectives, forming high calibre negotiating teams, defining each partner's contributions and rewards as well as protect any proprietary information, addressing termination clauses, penalties for poor performance, and highlighting the degree to which arbitration procedures are clearly stated and understood.

- Alliance Operation: Alliance operation involves addressing senior management's commitment, finding the quality of resources devoted to the alliance, relating of budgets and resources with strategic priorities, measuring and rewarding alliance performance, and assessing the performance and results of the alliance.

- Alliance Termination: Alliance termination involves winding down the alliance, for example when its objectives have been met or cannot be met, or when a partner adjusts priorities or re-allocated resources elsewhere.

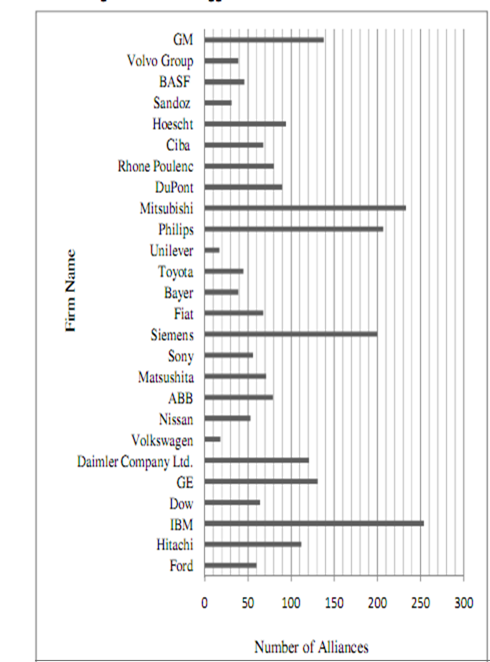

Number of alliances made by some large and medium scale firms (Schreiner, 2009)

Strategic alliances are the relatively continuing provisions, detached from institutional arrangement, linking associations to utilize resources and plan structures of independent organizations towards shared achievement objectives. For this, the joint achievement of independent organization's objectives are allied to business goals of other supporting organizations. Inter firm assistance, which is mainly targeted to align in strategically, also need to recognise critical hurdles that are important to be removed before proceeding towards encouraging unwavering collaboration in alliance formation. However, efforts in doing research are sometime not up to mark to identify structural magnitude in specific terms in order to support them for better performance leading to positive strategic alliance (Michael, et., al., 1995).

Success in Strategic Alliance

Theoretical studies have established that Strategic alliance is a rapport formed by two or more self-governing firms to realise mutually relevant objectives for constructive progress by involving the trade, distribution, mutual expansion of resources and competencies. There are definite factors that are important at each stage of alliance progression for the success of any sole alliance. These factors include scrutinizing and selecting a suitable strategic partner, designing and setting up appropriate authority and control to take care of the alliance, and the post formation evaluation stage, which includes supervising the alliance on standardized basis to realize the perceived worth (Gulati, 1998).Mutual Commitment of collaborator's to Success:

- Monetary success

- Company approaches that are consistent to the partnership

- Company goals that are communicated and agreed upon

- Alliance provides needed contributions/expectations

- Compatible goals/vision

- A joint need

- Shared values and corporate culture; trust is paramount

- Tremendous Communication

- History of successful partnering with organizational learning

- Good administrative level relationships

- Business health of both associates is good

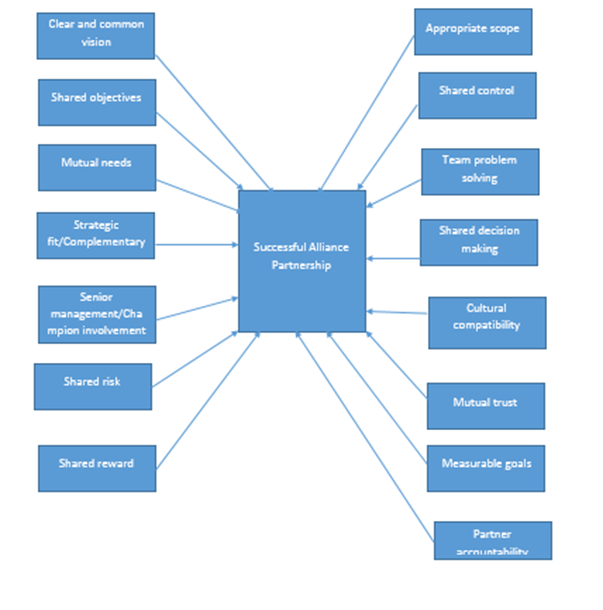

Biggs (2006) recognized some critical factors that determine the success of a strategic alliance:

Critical Success Factors affecting Strategic Alliances (Biggs, 2006)

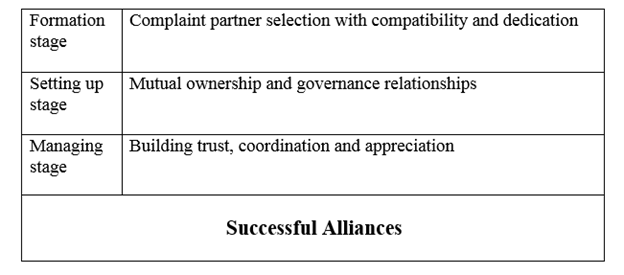

Determinants of Success in Alliances: There are some factors that are important to achieve success at each stage of alliance. In first stage of alliance, alliances are formed by scrutinizing and selecting a suitable and reliable strategic partner. In the second stage, the alliances are set, designed, job description and ownership at each level is made. In the third stage, there is proper management and post formation evaluation, which includes supervising the perceived worth of outcome.

Table: Stages performed in Successful Alliances (Kauser, 2004)

Benefits of strategic alliance:

International business may realize numerous advantages from strategic alliances that are as under (Bernadette Soares, 2007):

1. Ease of market entry: Improvements in telecommunications, computer technology and transportation have made entry into foreign markets by international firms easier. Entering foreign markets further confers benefits such as economies of scale and scope in marketing and distribution. The cost of entering an international market may be beyond the abilities of a single firm but, by entering into a strategic alliance with an international firm, it accomplishes the benefit of quick entry while curtails the cost. Choosing a strategic partnership as the entry mode may overcome the remaining difficulties, which could include entrenched competition and hostile government conventions.

2. Shared risks: Risk sharing is another common basis for undertaking a cooperative arrangement. When a market has just opened up, or when there is much vagueness and instability in a particular market, sharing risks becomes particularly important. The competitive business makes it difficult for business entering a new market or launching a new product, and strategic alliance is effective way to decrease or control a firm's risks.

3. Shared knowledge and expertise: Most firms are capable in some areas and deficit in other areas. Developing a strategic alliance can permit ready access to knowledge and expertise in an area that a company lacks. The information, knowledge and expertise that a firm gains can be used, not just in the joint venture project, but for other projects and purposes. The expertise and knowledge can range from learning to deal with government regulations, production knowledge, or learning how to acquire resources.

4. Synergy and competitive advantage: Strategic alliance is required to accomplish co-operation and a competitive advantage. Competition becomes more effective when associates leverage off each other's strengths, bringing synergy into the process that would be hard to achieve if attempting to enter a new market or industry alone.

Other benefits that Strategic alliance offer to companies are:

I. An alliance assists to enter new international markets by overcoming political, economic and social barriers. Due to government policies and rules, it is problematic to enter into new international markets. Powerful motive to create alliances is to decrease entry barriers by joining forces with other organizations.

II. Home market competitive position is protected by alliances. Entering international markets may affect domestic market but in international market, organization force foreign competitors at home divert their resources away from expansion which protects the home market.

III. Alliances aid in increasing distribution networks by acquiring new means of distribution.

IV. Alliances reduce the manufacturing costs, other costs and risks of the project, product or services by sharing between the alliance partners.

V. Strategic alliances in business helps to gain access to imperceptible assets like brand name, expertise etc.

VI. Due to alliances, competent rivals also collaborate which helps to decrease internal and external uncertainties in environment.

VII. Strategic alliances support to broaden product line, services processes and fill product line gaps in the current products. High cost and lack of technology may force a firm to seek a foreign partner to fill their product lines.

VIII. Strategic alliances permit companies to enter new markets and to attract many potential customers which expand their market share. Organizations working in stagnant industries enter alliances to grow its presence in emerging businesses.

IX. Strategic alliances lessen the jeopardy of future competition by entering into an alliance with another firm and it demonstrates many future opportunities as well.

X. Alliances permit firms to gain proficiency by realising economies of scales and vertical integration.

XI. Resources are augmented in strategic alliances. As the all partners of alliance provide resources. So the firms that have less resources of any kind they create strategic alliances.

XII. Strategic alliance is produced to gain new skills and knowledge. Gaining knowledge is one of the most significant factors in creating alliances. Collaborators in an alliance learn from each other's skills, capability, technology and technical standards.

XIII. Alliances assist to increase performance, productive capacity and existing market product and services by joint manufacturing and developing product cooperatively.

XIV. Alliances are also made by following industry trends to accomplish competitive advantages and increase revenues.

Causes of Unsuccessful Strategic Alliances:

Unsuccessful alliances cause many damages to the partners of alliance. Some of the causes are as following:

I. Problems relating control of strategy implementation is a factor in let-down of the alliance. When strategy implementation goes out of control of any of the organization in the alliance then the alliance may fail.

II. When firm depends specially on the partners of other alliances for skills, it is a disadvantage for the organization that depends on others.

III. When the perception of unequal gains prevail in alliance, partner getting less out of the alliance than those associates who gain more can cause problems and discrepancy which results in failure of alliance.

IV. When the collaborators in alliance do not manage the project properly, it creates problems when it is not planned that how, who, when and where the process should take place and how much time and resources must be committed to manage the alliance. The partners must plan and monitor the development of each step frequently.

V. Conflicts between the allies to decide the objectives and plans can cause a change in the feasibility and relation of a particular alliance.

VI. When the strategic alliances do not have control on elementary strategy and they depend upon the alliance for development of its overall business, and fail to concentrate on alliance goal and their organization goal separately then conflicts rise and partners may become rivals.

VII. It has been observed that differences in cultural values of partners may lead to failure as culture clashes and different thinking can create a situation where parties in organizations differ to some aspects of agreement.

VIII. Different cultures, environment and rules prevailing in partner organizations within same nationality also leads to failure of strategic alliances.

IX. When strategic alliances are shaped, many job positions and their reports are changed to attain the goal of alliance. There are role ambiguity and uncertainty about specific roles that may bind organizations from fulfilling their obligations created in the situation of alliance.

X. A partner may create manifold alliances with other competing organizations which may affect the alliance.

XI. Antitrust procedures leads to collapse of an alliance. It can limit the benefits of an alliance by inviting governmental involvement.

To summarize, Strategic alliances are vital tools in aggressive business environment. Management literature revealed that Strategic Alliance is an concurrence between two companies that work in similar manner in the market, that share resources to carry out a desired project for which both parties have some common interest. It can be said that strategic alliances can be formed as a single alliance between two companies and as numerous firm alliance involving more than two companies. A company can be involved in more than one alliance at the same time to gain benefits in different dimensions of its corresponding business operations and to focus objectively on current and potential markets. By developing strategic alliance, a company can develop and maintain a portfolio of alliances to gain competitive edge, access probable skills and resources, share expensive facilities like research labs, start state of the art joint manufacturing and/or distributions and enter new markets, and even though to avoid threats and weaknesses into prospects.